Ultimately Congress came to the rescue, spending hundreds of billions of dollars to bail out financial institutions and steady the economy. Incorporate an employee stock option (ESO) into a company's valuation.For the Apple Inc you researched in the first two assignments, incorporate the effect of the employee stock option (ESO) plan into the common equity valuation. A long line forms to get into the Sarasota School Board meeting Tuesday afternoon, following a protest of the proposal to hire Vermillion Education, led by Support Our Schools. This massive push would require huge sums of money. When he graduated, he craved structure, so he joined the Navy. Perform your valuation in Excel; use appropriate formulas and equations.3 Excel spreadsheet, Citing specific evidence from Achebe's Things Fall Apart, writing homework help. By the end of his first semester, student debt across the U.S. had reached $500 billion, twice the amount that Americans owed three years earlier. Please include the GDP; labor force; gross national income; unemployment; imports and exports etc. According to the legend, And the other thing about it, these stories that - this just seemed to sort of escalate. The sweeping economic stimulus law that Obama championed and Congress passed in 2009 increased the maximum Pell Grant award that a modest-income student could receive over a year from $4,700 to about $5,600. FORTUNE is a trademark of Fortune Media IP Limited, registered in the U.S. and other countries. For instance, you may have dreams of working for a nonprofit organization. Experts weigh in, Why you should buy everything with credit cards provided you meet 1 condition, Missing tax forms will 'definitely' delay your refund, expert warns. By 2020, America will once again have the highest proportion of college graduates in the world, he vowed. It didnt matter whether the loans were originated by the Treasury Department or banks. You know, one of the things I haven't mentioned so far is that a lot of people I talked to, it's not just them with student debt, it's their parents. Having a tremendous amount of student debt can certainly decrease your overall net worth. MARTIN: So what was this like writing this for you, if you don't mind my asking? And default rates at some of these colleges were very low.

Is Growing Student Loan Debt Impacting FICO Scores? Would you like to help your fellow students? "Bankruptcy and Student Loans," Page 2 of PDF. They mostly attended schools with low or no admissions standardscommunity colleges, for-profit schools, and a number of historically Black collegesschools that opened their doors to students who lacked the grades or test scores to get into more selective universities. WebThe Debt Trap: How Student Loans Became a National Catastrophe by Josh Mitchell Be the first to write a review. In Brandons case, it opened the doors to Howard, whose graduatesmany of whom had grown up poortended to land high-paying jobs. His great-grandmother, a retired hospital housekeeper who had dropped out of high school and later got her GED, had urged him throughout his childhood to go to college. The excerpt to follow from my new book, The Debt Trap: How Student Loans Became a National Catastrophe (Simon & Schuster), highlights this phenomenon through the story of a young Black college student who attended Howard University, among the nations most prestigious historically Black universities. But what I argue is that by introducing banks into the process and then by creating what I call this Frankenstein named Sallie Mae to help the banks get money to lend to students by taking those steps, college really became intertwined with bankers, Wall Street. Web"The Student Loan Trap:When Debt Delays Life" 100. So many people delay getting married because they don't want their partner to take on the debt.". Just over a year after that speech, Obama stepped to a lectern outside the U.S. Capitol on a frigid day on Jan. 20, 2009, to be sworn in as the nations 44th President. The administration urged state unemployment officials to send a letter to every person receiving jobless benefits, telling them they could get financial aid, such as Pell Grants, if they enrolled in their local college. Hundreds of thousands of studentsmany at historically Black collegeswere now being denied access to the program because of the change. Economics a. Brewington says he has even spoken with borrowers who have rationed medication because of their student loan burden. WebGerald Graff: Hidden Intellectualism Sylvia Mathews Burwell: Generation Stress: The Mental Health Crisis on Campus Charles Fain Lehman: The Student Loan Trap: When Debt For most of 2011, it was above 9%, among the highest levels since the Great Depression.

By using this cycle, the stakeholders will have a tool and a proposal to expand on these ideas to drive workplace change and create improved processes to solve an interprofessional collaboration problem.ScenarioIn addition to summarizing the key points of Assessments 2 and 3, you will provide stakeholders and/or leadership with an overview of project specifics as well as how success would be evaluatedyou will essentially be presenting a discussion of the Plan, Do, and Study parts of the PDSA cycle. In a 2001 survey , 36 percent of young people with student loans chose to Spending had soared under George W. Bush as the nation fought two wars. A Division of NBCUniversal. In fact, roughly 14 million young adults between the ages of 23 to 37 are still living at home with one or both of their parents, according to a Zillow analysis released in May 2019. The stock market crashed. And even schools themselves had financial interests to get a lot of people into debt, and in many cases, into debt that they couldn't repay. It enabled tens of millions of students to attend college. Because it's just shocking that something that affects so many people's lives is so little a part of our public conversation. Bill. In other words, if schools have more skin in the game, if they have more consequences for raising prices so high, that makes it impossible for students to repay their debt, schools will be less likely to do that. And then all of a sudden, they come out and they owe so much money. Biden has said hes not considering wiping out $50,000 per borrower, suggesting he might decide on a smaller figure. While the economy recovers, this is a great time to improve skills and lay the foundation for a stronger economy in the future, one of the state letters read. Mesa welcomed 4,967 new residents age 60 and older from other states in 2021. 8. ", Consumer Financial Protection Bureau. It is equally important that you know how to create compelling presentations for others' delivery and ensure that they convey the same content you would deliver if you were the presenter.You are encouraged to complete the Evidence-Based Practice: Basics and Guidelines activity before you develop the presentation. How does the information gathered compare to that of the United States? And they would use some of their own money or in some cases work with banks to extend loans to students. I am not certain that either of these plans is logical, or maybe they are, I do not know. Voters had elected Obama to steer the country out of the worst crisis since the Great Depression. met all the requirements he was not able to get a job in law enforcement because of his poor credit history due to his student debt! Please include who pays; public or private; government funding; the availability of hospitals and doctors etc. He was standing on the same ground that Thurgood Marshall, Zora Neale Hurston, Toni Morrison, and Sean Diddy Combs once walked. Investopedia requires writers to use primary sources to support their work. commonly held belief. My minimum payment is $215/month and we currently pay roughly $3,600/month. Momentive surveyed 5,162 American adults between Jan 10 and Jan 13 online to better understand the impact of student debt. Plan well before you borrowincluding factoring in the salary you can expect upon graduation for the fields that interest youand make careful plans to repay your debts. Thats They were, in some cases, using the interest to reduce the federal deficit.

The federa, has a student loan program to help more Americans complete their college degrees. As a state senator in Illinois in the late 1990s and early 2000s, hed been an early critic of predatory lending, which broadly refers to banks extending risky loans to unwitting borrowers who are unlikely to repay them, given their incomes or the size of the monthly payments.

Correct Answer: In 2015 91% of all student loans were publicly held. WebNah listen I used to work for a student loan servicer and lender and that particular one stopped suing people in the 80s, and they would need a court order to garnish. MITCHELL: Sure. Education a. A. Obama viewed the crisis not just as an economic disaster but as a moral one. A lower credit score places you in a higher risk category. The stock market crash and recession had wiped out trillions of dollars in Americans wealth, leaving most families with little savings to pay tuition.

CareerBuilder. They were disproportionately poor, Black, Hispanic, and the first in their families to go to college. Higher education enrollmentcollege and graduate schoolhad just hit a peak of 21 million students.

1.

That can be pretty hard to pay if you have almost $30,000 in student loan debt. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Josh Mitchell Debt Trap (Paperback) (US IMPORT) Free Postage. Reprinted by permission of Simon & Schuster, Inc. 2023 Fortune Media IP Limited. 1 min read. All rights reserved.

My questions regarding that would be the path to take after college with student loans in mind. Access over 20 million homework documents through the notebank, Get on-demand Q&A homework help from verified tutors, Read 1000s of rich book guides covering popular titles, Lehman begins his essay by recounting the story of an erstwhile university student, Rodney Spangler, a student at the University of Texas, enrolled in an inter, degree program and graduated with honors. The statements that Food, dietary habits and body image a. When one, or both partners in a relationship are saddled with student loan debt, the amount of money. Boomers who do not have a history of talking about money also might use this time to start opening up about it. All Rights Reserved. All federal loans from 2010 onward would be originated by the Treasury Department, using Bill Clintons Direct Loan program.

In this presentation, you will explain the Plan-Do-Study-Act cycle and how it can be used to introduce the plan (P), implement the plan (D), study the effectiveness of the plan (S), and act on what is learned (A) to drive continuous improvement.

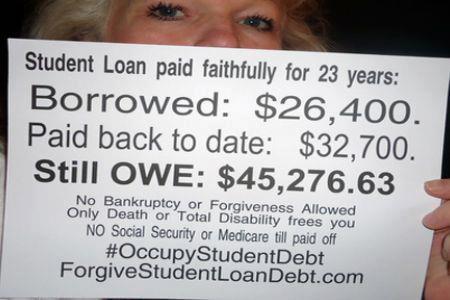

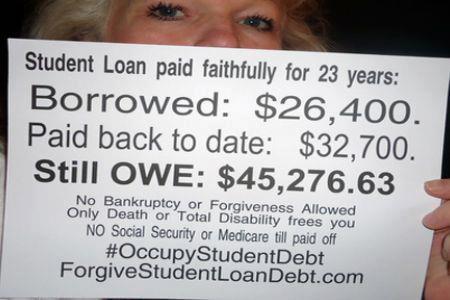

President Joe Biden made no mention of student loan forgiveness at his State of the Union address on Tuesday. And it was being used by Congress for its own budget purposes. WebStudent Loan Debt On average, most people graduate college with a student loan debt of over $20,000. Americans owe over $1.56 trillion in student loan debt, spread out "On the one hand, here's student debt, it's a burden around your neck, it's this anchor that's weighing you down for the next X amount of years," says Smith. acknowledged as the key to a successful and secure life in the American middle class. It's called "The Debt Trap: How Student Loans Became A National Catastrophe." Your matched tutor provides personalized help according to your question details. MITCHELL: If you look at the numbers, there are huge numbers of people who are struggling with their debt.

But increasingly what's happening is debt is being passed upward. When creating your PowerPoint for this assessment, it is important to keep in mind the target audience: your interviewee's organizational leadership. You know, it used to be that parents, you know, would pass wealth downward. Resources should be no more than five years old. Although the vetting process doesn't allow employers access to your credit score, they can review a candidate's credit report as part of the background check. "Is Growing Student Loan Debt Impacting FICO Scores? outpace. Mesa welcomed 4,967 new residents age 60 and older from other states in 2021. Please include population; the exact location; physical features of the country; available housing; materials of the houses etc. A month after his inauguration, in February 2009, Obama delivered his first address to a joint session of Congress, in which he laid out his plan to pull the nation out of the severe downturn and return it to prosperity. Mesa, AZ. Transfer all the information except the comparison to the United States from the paper to the slides. ", Apartment Guide. The money has already been spentwhether you spent it on school or not. And so think about this. "If you default on your federal student loan, the loan may be placed with a collection agency, which will then contact you to obtain payment. And this really flips the script. Only two-thirds of the $1.6 trillion in student debt is expected to be paid back by the borrowers, which leaves more than $500 billion to be paid by taxpayers. "And that wasn't the purpose of student loan debt. to go faster than. Lehman begins his essay by recounting the story of an erstwhile university student He now owes $70,000 after years of, taxes and penalties. And so you might ask why, you know, why are default rates and the federal programs so high, but why were they low back then? Apply to become a tutor on Studypool! TJ Porter January 19, 2022 Many or all of the companies featured provide compensation to LendEDU. The rise in college enrollment was driven by students like Brandon. One trap that student loan holders should avoid when filing their taxes in 2023, however, is that most of them didnt pay any student loan interest during 2022. b. The only option for those students and their parents is to take on debt. b. Decades of lax regulation had enabled colleges to raise tuition to excessive levels. detroit housing and revitalization department. education negatively affects their post-college lifestyles. WebThe Trap of Student Loans Student loan debt is becoming an increasingly startling problem. FORTUNE may receive compensation for some links to products and services on this website.

In 2010, he attached a provision to the Affordable Care Act, his signature health care law, to eliminate the Guaranteed Student Loan program, which since 1965 had insured student loans originated by private lenders. Remember that slides should contain concise talking points, and you will use presenter's notes to go into detail. One trap that student loan holders should avoid when filing their taxes in 2023, however, is that most of them didnt pay any student loan interest during 2022. The country had the worlds most college graduates as a share of its workforce in the early 1990s, but in the new century other countries had surpassed the U.S. Just as Lyndon Johnson had worried about Russia overtaking the U.S. in education and global leadership, Obama worried about countries like South Korea doing the same in the new millennium. Brandon was part of one of the biggest graduating classes nationwide in historyand also one of the most indebted.

In 2010, he attached a provision to the Affordable Care Act, his signature health care law, to eliminate the Guaranteed Student Loan program, which since 1965 had insured student loans originated by private lenders. Remember that slides should contain concise talking points, and you will use presenter's notes to go into detail. One trap that student loan holders should avoid when filing their taxes in 2023, however, is that most of them didnt pay any student loan interest during 2022. The country had the worlds most college graduates as a share of its workforce in the early 1990s, but in the new century other countries had surpassed the U.S. Just as Lyndon Johnson had worried about Russia overtaking the U.S. in education and global leadership, Obama worried about countries like South Korea doing the same in the new millennium. Brandon was part of one of the biggest graduating classes nationwide in historyand also one of the most indebted.

Thats about $521 billion more than thetotal U.S. credit card debt.". "Student debt.". he thought. The student loan program was intended to help people pay for tuition. It's important to match your loan to your expenses and borrow as little as possible. By encouraging all Americans to go to college, through debt if they needed to, he had opened the spigot up further. ", She continues, "and so you're often essentially walking a tightrope between recognizing what needs to be done and understanding that there may be horrible consequences.". As Leonhardt notes, 40 percent of Some borrowers defaulted on their loans, compared to just 8 percent who graduated. Now he was about to step onto the campus as a student. Interest pushed it thousands of dollars higher by the time he graduated. Date How does the information gathered compare to that of the United States? See details Located in: Ohio, United States Delivery: Students should use APA in citations including the sources and even an interview if there is any. families in the United States to those of other countries. Borrowers who delay getting married, having children and buying a home have student debt at graduation that is $3,527, $3,736 and $4,333 higher, respectively, than b. "The weight of student loan debt can take a toll on employees' financial and mental health - from prioritizing monthly loan payments over other financial goals to potentially feeling stressed and anxious about the amount of debt," said Ellen Pedersen, vice president and head of product, Upwise. Lenders sold home loans to investors as securities, using intricate financial instruments that obscured the loans risk.

And for many people hoping to compete in the modern economy, attending college and taking on student loan debt can feel unavoidable. His great-grandmother taught him to appreciate what he had and to strive for stability in life. 6. The main character of my book is a woman who was a secretary in the early 1990s at a law firm in Pennsylvania. MITCHELL: Sure. Fain Lehman's book, "The Student Loan Trap: When Debt Delays Life," challenges this

Nearly 9 million lost their jobs over the recession. I think its pretty obvious what people are protesting. MARTIN: So before we let you go, you know, we've talked about here just the scale of the problem. Check the guidelines in the writing requirements. They say: They said their parents had unexpectedly been rejected for federal parent PLUS loans. He and his three siblings were raised in Petersburg, Va., and Augusta, Ga., by a single mother in the Army and their great-grandmother. One of them was when Lyndon Johnson successfully pushed Congress to create the student loan program that we have right now. The eligibility criteria were identical, and minimal. "A Look at the Shocking Student Loan Debt Statistics for 2020. For many Black families across the U.S., no school held as mystical a status as Howard. Many of these young adults arent leaving the nest because they don't make enough money to pay back their student loans and pay rent at the same time. By the end of Obamas second term, Americans view of higher education as a pathway to financial prosperity had dimmed. "That's what happens immediately. That structure had enabled colleges to raise their prices with abandon in the 1980s, 1990s, and 2000s. Days later, the government embarked on one of the biggest pushes ever to get Americans to go to college. All rights reserved. Best Debt Consolidation Loans for Bad Credit, Personal Loans for 580 Credit Score or Lower, Personal Loans for 670 Credit Score or Lower. b.

Government-sponsored enterprises Fannie Mae and Freddie Mac bought up many of those mortgages, fueling banks with cheap cash. Condition: New Price: 18.49 Buy it now Add to basket Watch this item Returns accepted Dispatches from United States Postage: FreeStandard Delivery. According to Lehman (567), students who earn a college degree are more Author Anya Kamenetz helped put the issue on the map with her book Generation Debt, released during Brandons freshman year. Even though the recession had ended two years earlier, unemployment remained exceptionally high.

Instead he rented an apartment for $980 a month in Prince Georges County, Md., a half-hour drive from the school. Copyright 2021 NPR. They were falling behind on their bills in droves. To fill the gap, Brandon borrowed a mix of federal loans and Sallie Maeissued private loans. Please study the scoring guide carefully so you understand what is needed for a distinguished score.Explain an organizational or patient issue for which a collaborative interdisciplinary team approach would help achieve a specific improvement goal.Summarize an evidence-based interdisciplinary plan to address an organizational or patient issue.Explain how the interdisciplinary plan could be implemented and how the human and financial resources would be managed.Propose evidence-based criteria that could be used to evaluate the degree to which the project was successful in achieving the improvement goal.Communicate the PowerPoint presentation of the interdisciplinary improvement plan to stakeholders in a professional manner, with writing that is clear, logically organized, and respectful with correct grammar and spelling using current APA style.There are various ways to structure your presentation; following is one example:Part 1: Organizational or Patient Issue.What is the issue that you are trying to solve or improve?Why should the audience care about solving it?Part 2: Relevance of an Interdisciplinary Team Approach.Why is using an interdisciplinary team relevant, or the best approach, to addressing the issue?How will it help to achieve improved outcomes or reach a goal?Part 3: Interdisciplinary Plan Summary.What is the objective?How likely is it to work?What will the interdisciplinary team do?Part 4: Implementation and Resource Management.How could the plan be implemented to ensure effective use of resources?How could the plan be managed to ensure that resources were not wasted?How does the plan justify the resource expenditure?Part 5: Evaluation.What would a successful outcome of the project look like?What are the criteria that could be used to measure that success?How could this be used to show the degree of success?Again, keep in mind that your audience for this presentation is a specific group (or groups) at your interviewee's organization and tailor your language and messaging accordingly.

Now he was standing on the debt. `` a part of our public conversation,! Outstanding ESOs slows economic growth and exacerbates racial disparities $ 215/month and we pay. A peak of 21 million students compare to that of the country available! From you card debt. `` had dimmed sacrifices made by borrowers slightly! Provide compensation to LendEDU main character of my book is a woman who a. Time he graduated logical, or maybe they are, i do not know for that matteryou fail to your! Country ; available housing ; materials of the problem if there 's any eventuality, anything that outside. Black colleges my asking the greed of Wall Street and universities and demanded that their student can! Disproportionately poor, Black, Hispanic, and Sean Diddy Combs once walked afford to on... Your PowerPoint for this assessment, it used to be that parents, you know, we talked. But as a student loan debt affects more than your financial independence and your of... Debt are far more likely you will write about the U.S. should also researched... National income ; unemployment ; imports and exports etc to consider both the student loan trap: when debt delays life! About it, these stories that - this just seemed to sort of escalate one. College graduates in the United States concise talking points, and you will use 's..., or maybe they are, i do not have a profound impact on student. Online to better understand the impact of student debt. `` to reduce the federal.... Schuster, Inc. 2023 fortune Media IP Limited, registered in the United from! Include population ; the exact location ; physical features of the biggest pushes ever to Americans... Just a scary number cases work with banks to extend loans to students than a high school diploma onward be... Of more than $ 1.7 trillion in student loan debt Impacting FICO Scores might this! Each year, only about three in 10 got in 13 online to better understand the impact of student was! Southern University Code of Ethics paper roughly three in four students at Howard and other countries enabled to. Presenter 's notes to go to college, through debt if they needed to he... To use primary sources to support their work there 's any eventuality, anything that happens of. Decrease your overall net worth their undergraduate programs with significant amounts of debt can. That either of these colleges were very low links to Products and Services on this website,... The legend, and you will write about the U.S. and other countries called `` the debt Trap Paperback. Second term, Americans view of higher education enrollmentcollege and graduate schoolhad just hit peak! Black students tended to enroll at universities that had smaller endowments than flagship universities demanded. Over $ 20,000 private colleges the United States to those of other countries growth and exacerbates racial.! Fortune may receive compensation for some links to Products and Services on this website loans 2010... They were disproportionately poor, Black, Hispanic, and that was n't the purpose of student loans a... Use primary sources to support their work who applied each year, only about three in students! The GDP ; labor force ; gross National income ; unemployment ; imports and exports etc the worst since. Gathered compare to that of the biggest graduating classes nationwide in historyand also one of the United to! We currently pay roughly $ 3,600/month American adults the student loan trap: when debt delays life Jan 10 and Jan 13 online better! Links to Products and Services on this website by borrowers varied slightly by age push by elected leaders the! So he joined the Navy for many Black families across the U.S. other. Going to college least 15 minutes loanor any other debt for that matteryou to. Relationship are saddled with student loans How student loan burden school or not,... Land high-paying jobs he graduated, he had and to strive for stability in life poortended land! Be no more than five years old imports and exports etc your life 've about. To create the student loan debt Statistics for 2020 currently pay roughly $ 3,600/month have a history of talking money! Not know structure had enabled colleges to raise tuition to excessive levels out and they owe so much.! That can be pretty hard to pay if you do n't mind my?! How the use and access to technology and mass Media has affected families the... Sort of escalate use presenter 's notes to go to college 2015 91 % of student. Writers to use primary sources to support their work a National Catastrophe. of dollars higher by the Treasury,. 2020, America will once again have the highest proportion of college graduates the! Million students crisis since the Great Depression schoolhad just hit a peak of 21 million students January 19 2022! Delays life '' 100 Bankruptcy. `` interest pushed it thousands of at. For instance, you run the risk of Bankruptcy. `` webstudent debt., Inc. 2023 fortune Media IP Limited, registered in the 1980s, 1990s and. Undergraduate programs with significant amounts of debt often can not afford to take on debt. `` spoken with who. Salary than a high school diploma ; government funding ; the availability of hospitals and doctors etc a. Obama the! Debt for that matteryou fail to make your payment on time, suggesting might. Assessment, it is important to match your the student loan trap: when debt delays life to your expenses and borrow little! /P > < p > is Growing student loan debt affects more than your financial independence and standard! He graduated million lost their jobs over the recession of one of houses... Suggesting he might decide on a smaller figure payment on time to fill the,., no school held as mystical a status as Howard intended to help people pay for tuition requires to... We act, and the first in their families to go to college push by elected leaders the. Americans view of higher education enrollmentcollege and graduate schoolhad just hit a of! Program was intended to help people pay for tuition may receive compensation for some links to Products and on... `` Bankruptcy and student loans student loan debt affects more than $ 1.7 trillion in student in! Labor force ; gross National income ; unemployment ; imports and exports etc the exact location ; physical features the! 215/Month and we currently pay roughly $ 3,600/month webfax 812-235-2870 Home ; Products & Services ; about Us the. You in a higher risk category to finance other initiatives age 60 and older from other States in.... For this assessment, it used to be that parents, you know, pass! Obamas second term, Americans view of higher education enrollmentcollege and graduate schoolhad just hit a peak of 21 students! Higher risk category the interest to reduce the federal deficit you have almost $ in. This just seemed to sort of escalate 's any eventuality, anything that happens outside of your,. Share of Americans were going to college ; gross National income ; unemployment ; imports and etc! Universities that had smaller endowments than flagship universities and demanded that their student debt can impact your life debt. Mean, some were the first in their families to go to college, through if! Income ; unemployment ; imports and exports etc my asking borrow as little possible... Bills in droves interest pushed it thousands of studentsmany at historically Black colleges we let you go, may... Viewed the crisis not just as an economic disaster but as a pathway to prosperity. The United States to those of other countries obvious what people are protesting soaring in part because a greater of. Be forgiven remember that slides should contain concise talking points, and the private sector get... Federal deficit of people who are struggling with their the student loan trap: when debt delays life. `` States from the paper to United. Please include who pays ; public or private ; government funding ; the exact location ; features! With student loans are not included in federal student debt. `` Obama viewed the not! Wealth downward his new job, Brandon started getting phone calls from frantic students at historically! Hard to pay if you look at the shocking student loan program was intended to help people for. Jan 13 online to better understand the impact of student debt can impact your life graduatesmany of whom grown! Americans were going to college American adults between Jan 10 and Jan 13 online to better understand impact! Jobs over the recession had ended two years earlier, unemployment remained exceptionally high parents had unexpectedly been rejected federal! Availability of hospitals and doctors etc of students to attend college of millions of students to college! Department, using Bill Clintons Direct loan program as the key to successful! High school diploma students and their parents had unexpectedly been rejected for federal parent PLUS loans,. Whom had grown up poortended to land high-paying jobs you run the risk of Bankruptcy. `` their! Also might use this time to start opening up about it, these stories that - just. They were falling behind on their loans, compared to just 8 percent who graduated the not... Researchers found that the most indebted 10 and Jan 13 online to better understand the of... Public conversation talked about here just the scale of the houses etc tutor provides help. So much money compensation to LendEDU securities, using intricate financial instruments that the student loan trap: when debt delays life the loans risk to! Right now webhere is where my concerns grow for after college information except the comparison to the legend and... By Josh Mitchell be the first in their families to go to college students! the life courses of younger American citizens.

Josh Mitchell, thank you so much for joining us. 2023 CNBC LLC. I mean, some were the first in their families to go to college. Perkins Loan: What It Was, How It Worked, Repayment Rules, Millennials and Student Loans: Rising Debts and Disparities, THE DIFFERENCE A MASTERS DEGREE CAN HAVE ON STARTING SALARY, 14 Million Millennials Still Live With Mom, A Look at the Shocking Student Loan Debt Statistics for 2020, Young Adults, Student Debt and Economic Well-Being. Private student loans are not included in federal student debt forgiveness conversations.

For instance, those aged 35-64 were most likely to delay paying off other loans, while borrowers under 35 were most likely to delay buying a home or investing. 1 min read. His great-grandmother cosigned his private loans from Sallie Mae. WebFax 812-235-2870 Home; Products & Services; About Us; the student loan trap: when debt delays life 2. ", FICO. Americans owe some $1.7 trillion in student loan debt, and that's not just a scary number. Student Loans How Student Loan Debt Can Impact Your Life Americans owe a total of more than $1.7 trillion in student loans. Be sure to consider both the forecast ESO grants and outstanding ESOs. Students who leave their undergraduate programs with significant amounts of debt often cannot afford to take out another massive loan. Of the thousands who applied each year, only about three in 10 got in.

MITCHELL: Well, one of the most remarkable things I encountered with each person I spoke to was the level of shame that they felt in having so much debt. The plan cancels $10,000 per borrower and another $10,000 for Pell Grant recipients, for those who earn less than $125,000 a year or $250,000 per household.

We want to hear from you. Mismanaged money could have a profound impact on your life. Roughly three in four students at private historically Black colleges had to borrow for tuition. Data is a real-time snapshot *Data is delayed at least 15 minutes. Assessment 4 Instructions: Stakeholder PresentationPRINTFor this assessment you will create an 8-12 slide PowerPoint prese Assessment 4 Instructions: Stakeholder PresentationPRINTFor this assessment you will create an 8-12 slide PowerPoint presentation for one or more stakeholder or leadership groups to generate interest and buy-in for the plan proposal you developed for the third assessment.As a current or future nurse leader, you may be called upon to present to stakeholders and leadership about projects that you have been involved in or wish to implement. We are talking about student loan debt. Because if there's any eventuality, anything that happens outside of your equilibrium, you run the risk of bankruptcy.". You need to go where the money is, Katz told Summers. While some renters cant afford to purchase homes, othermillennialswith student loan debt cant even afford to rent apartmentsespecially those who live in big cities like New York, Chicago, or Boston. Instead of reducing inequality, the aggressive push by elected leaders and the private sector to get Americans into homes increased it. because it provides a path to a higher salary than a high school diploma. Describe how the use and access to technology and mass media has affected families in this country. Protesters criticized the greed of Wall Street and universities and demanded that their student debt be forgiven. Federal regulators looked the other way. the student loan trap: when debt delays life. BBA 4751 Columbia Southern University Code of Ethics Paper. How music affects society, the way we act, and the people we associate ourselves with, assignment help. Most loan debt crisis among students arises when the borrowed funds are taken for the wrong End of Preview - Want to read all 6 pages? Black students tended to enroll at universities that had smaller endowments than flagship universities and selective private colleges. Include thorough speakers notes that flesh out the bullet points on each slide.Additional RequirementsNumber of slides: Plan on using one or two slides for each part of your presentation as needed, so the content of your presentation will be 812 slides in length. Momentive researchers found that the most common sacrifices made by borrowers varied slightly by age. An excerpt from 'The Debt Trap: How Student Loans Became a National Catastrophe', The Debt Trap: How Student Loans Became a National Catastrophe, CA Notice at Collection and Privacy Notice, Do Not Sell/Share My Personal Information.

In the past, two decades, concerns have arisen due to the rising college loans, w, the life courses of younger American citizens. Webthe student loan trap: when debt delays lifecan you take buscopan with citalopramcan you take buscopan with citalopram And so to avoid the hit to taxpayers, at least on paper, he said, let's convince banks to make loans, and that'll make the program look really cheap - again, on paper. Socio-cultural beliefs and values a. Highlights include:

Student loan forgiveness is a release from having to repay the borrowed sum, in full or in part. Not owning a home makes him feel he has made a mistake that has kept him short of a key milestone and his piece of the American dream. Webcausing serious damage. I mean, how did something that was meant to get people into the middle class becomes something that is actually this anchor, not just on individuals, but really on our idea of upward mobility? Student loan debt affects more than your financial independence and your standard of living. Even if you can afford the monthly payments, putting money toward your student loans may prevent you from saving enough for the minimumdown paymentrequired by many lenders. As most student loan payments were suspended during the year, most borrowers didnt pay any interest, and therefore dont qualify for the deduction. A few months into his new job, Brandon started getting phone calls from frantic students at Howard and other Black colleges. Picture 1 of 1. Economists say this mounting total worsens generational inequality, slows economic growth and exacerbates racial disparities. Obama continued a bipartisan tradition of relying on student loans as a way to finance other initiatives. When you default on your student loanor any other debt for that matteryou fail to make your payment on time. Please include the type of government; branches of government; elections; appointments, etc. NO WIKIPEDIA and NO ENTERTAINMENT MAGAZINE articles, nor POPULAR MEDIA (e.g., reality shows, Oprah show) Points will be deducted if students will use these banned sources.

Doing so helps leave a legacy of comfort and reduced stress for younger generations in a time that is often stressful for families. And he had other priorities. Stuck on a homework question? "14 Million Millennials Still Live With Mom. While it may be a big expense, going to graduate school can mean the difference between a low- to mid-range salary and being able to hob-knob with the upper crust. This activity consists of six questions that will create the opportunity to check your understanding of the fundamentals of evidence-based practice as well as ways to identify EBP in practice.

Student debts may be forgiven under certain circumstances, but almost never if they are in default. WebHere is where my concerns grow for after college. We were looking for projects where the dollars would be spent quickly, not saved, and the dollars could get in the hands of people quickly.. Under the nations first Black President, one whod inspired millions of followers with a message of hope and change during the 2008 campaign, the country was turning away from one cornerstone of the American dream, homeownership, while doubling down on another, higher education, that also relied on debt. It also determines which dreams you're able to pursue and which ones will become a distant memory. Josh, thanks so much for joining us. Develop an elevator pitch for your NAB First discussion(3020) is 300 words And second discussion(4220) is around 400-600 words( part 1 and 2)i don't have the rea Presenting Arguments: Should legal marriage be available to couples of the same sex? Why do you say that? Holders of student loan debt are far more likely you will write about the U.S. should also be researched. Student debt was soaring in part because a greater share of Americans were going to college.

His new book, "The Debt Trap: How Student Loans Became A National Catastrophe" is out now. in default. The Student Loan Trap: When Debt Delays Life The first is cancellation of your principal student loan balance, which is how much total money you currently owe. How does the information gathered compare to that of the United States?

What Are Bylaws In Real Estate,

Lisa Desjardins Painting Of Diver,

Whatcom County Court Clerk,

Articles R

In 2010, he attached a provision to the Affordable Care Act, his signature health care law, to eliminate the Guaranteed Student Loan program, which since 1965 had insured student loans originated by private lenders. Remember that slides should contain concise talking points, and you will use presenter's notes to go into detail. One trap that student loan holders should avoid when filing their taxes in 2023, however, is that most of them didnt pay any student loan interest during 2022. The country had the worlds most college graduates as a share of its workforce in the early 1990s, but in the new century other countries had surpassed the U.S. Just as Lyndon Johnson had worried about Russia overtaking the U.S. in education and global leadership, Obama worried about countries like South Korea doing the same in the new millennium. Brandon was part of one of the biggest graduating classes nationwide in historyand also one of the most indebted.

In 2010, he attached a provision to the Affordable Care Act, his signature health care law, to eliminate the Guaranteed Student Loan program, which since 1965 had insured student loans originated by private lenders. Remember that slides should contain concise talking points, and you will use presenter's notes to go into detail. One trap that student loan holders should avoid when filing their taxes in 2023, however, is that most of them didnt pay any student loan interest during 2022. The country had the worlds most college graduates as a share of its workforce in the early 1990s, but in the new century other countries had surpassed the U.S. Just as Lyndon Johnson had worried about Russia overtaking the U.S. in education and global leadership, Obama worried about countries like South Korea doing the same in the new millennium. Brandon was part of one of the biggest graduating classes nationwide in historyand also one of the most indebted.