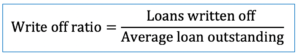

write off directors loan account

If the director is also a participator the write off will not be taxable income of the deceased but will be income of the estate. How Do You Put Money Into Your Limited Company? This field is for validation purposes and should be left unchanged. If a payment is made to a director and it does not form part of their normal remuneration package (salary and dividends) the payment is usually set against their DLA. When this happens, HMRCs view is that the director doesnt intend to pay the money back and the full amount will be taxed. What are directors loan accounts? Although the money in your limited company bank account belongs to the company, as a director of the company you can make withdrawals using a directors loan. Essentially, HMRC defines a directors loan as money taken from your company that isnt either: A salary, dividend or expense repayment We always recommend speaking to an accountant for a more in-depth analysis of your circumstances. Taking periodic Dividends draws down the equity in the business. We have no hidden fees, no limitations, but a wide range of accounting software features that help you easily manage your business. The directors loan account (DLA) is where you keep track of all the money you either borrow from your company, or lend to it. This is a defence used by many directors following insolvency. Where there is more than one Director in the business, a loan account is typically set up for each person in the balance sheet so that each individual can see how they are owed/owe the business, Although there is no legal requirement to separate Directors loans by person. If you take money out of the company, the directors loan account will be in debit and you will owe the company money. Yes. During the accounting period, the director's loan account (DLA) was overdrawn by 15,000 and remained unpaid nine months and one day after the accounting period ended. By submitting, you agree to our Privacy Policy.

If the director is also a participator the write off will not be taxable income of the deceased but will be income of the estate. How Do You Put Money Into Your Limited Company? This field is for validation purposes and should be left unchanged. If a payment is made to a director and it does not form part of their normal remuneration package (salary and dividends) the payment is usually set against their DLA. When this happens, HMRCs view is that the director doesnt intend to pay the money back and the full amount will be taxed. What are directors loan accounts? Although the money in your limited company bank account belongs to the company, as a director of the company you can make withdrawals using a directors loan. Essentially, HMRC defines a directors loan as money taken from your company that isnt either: A salary, dividend or expense repayment We always recommend speaking to an accountant for a more in-depth analysis of your circumstances. Taking periodic Dividends draws down the equity in the business. We have no hidden fees, no limitations, but a wide range of accounting software features that help you easily manage your business. The directors loan account (DLA) is where you keep track of all the money you either borrow from your company, or lend to it. This is a defence used by many directors following insolvency. Where there is more than one Director in the business, a loan account is typically set up for each person in the balance sheet so that each individual can see how they are owed/owe the business, Although there is no legal requirement to separate Directors loans by person. If you take money out of the company, the directors loan account will be in debit and you will owe the company money. Yes. During the accounting period, the director's loan account (DLA) was overdrawn by 15,000 and remained unpaid nine months and one day after the accounting period ended. By submitting, you agree to our Privacy Policy.  A write off should be agreed by shareholders, rather than the directors, and if a companys solvency is in question, directors should take legal advice before writing offtheir loans. The executors and beneficiaries of the estate will need to consider how the write off will be taxed. We explain the background to this move, and its benefits. Unless you repay that loan within nine months of the end of the period, your company will generally have to pay tax on the outstanding loan amount. That must be included on the directors own tax return within the additional information section. Directors should be aware that if too much money is borrowed and the company is unable to pay its creditors, the company could be forced into liquidation and the liquidator can take legal action against the director to collect the debt. There are many reasons why you might need to take money from your company, for example covering an unexpected personal expense.

A write off should be agreed by shareholders, rather than the directors, and if a companys solvency is in question, directors should take legal advice before writing offtheir loans. The executors and beneficiaries of the estate will need to consider how the write off will be taxed. We explain the background to this move, and its benefits. Unless you repay that loan within nine months of the end of the period, your company will generally have to pay tax on the outstanding loan amount. That must be included on the directors own tax return within the additional information section. Directors should be aware that if too much money is borrowed and the company is unable to pay its creditors, the company could be forced into liquidation and the liquidator can take legal action against the director to collect the debt. There are many reasons why you might need to take money from your company, for example covering an unexpected personal expense.  In the case of compulsory liquidation, it will be the Official Receiver who liquidates the company. The insolvency practitioner will look to recoup any unlawful dividends from the directors who authorised them as well as any outstanding Directors Loan Accounts. If youve had enough of juggling spreadsheets and never finding the right invoice, your business needs Crunchs free accounting software, whether you are a freelancer, sole trader or limited company. Offices are closed on Saturdays & Sundays. This way a director has funds available to draw on without the added complication of having to review for RTI reporting. HMRC defines a directors loan as money taken from your company that isnt either: If you have paid business expenses personally, you can pay yourself back using the company bank account. loan creditor) or their associate (e.g. They will take into account liabilities such as corporation tax. The above information is for general guidance on your rights and responsibilities and is not legal advice. At Lincoln & Rowe we understand the importance of helping our clients keep their business running smoothly. The taxable benefit of interest calculatedis required to be. By writing off the directors loan, its status will change from debt to income thus giving rise to income tax.

In the case of compulsory liquidation, it will be the Official Receiver who liquidates the company. The insolvency practitioner will look to recoup any unlawful dividends from the directors who authorised them as well as any outstanding Directors Loan Accounts. If youve had enough of juggling spreadsheets and never finding the right invoice, your business needs Crunchs free accounting software, whether you are a freelancer, sole trader or limited company. Offices are closed on Saturdays & Sundays. This way a director has funds available to draw on without the added complication of having to review for RTI reporting. HMRC defines a directors loan as money taken from your company that isnt either: If you have paid business expenses personally, you can pay yourself back using the company bank account. loan creditor) or their associate (e.g. They will take into account liabilities such as corporation tax. The above information is for general guidance on your rights and responsibilities and is not legal advice. At Lincoln & Rowe we understand the importance of helping our clients keep their business running smoothly. The taxable benefit of interest calculatedis required to be. By writing off the directors loan, its status will change from debt to income thus giving rise to income tax.  The benefit (the amountwritten off)is reported on form P11D and Class 1 NICs is calculated on the value of the benefit via the payroll. WebThe way out of this very unsatisfactory dilemma, I would suggest, would be for the directors to resolve to write off Mr Youngs overdrawn loan account.

The benefit (the amountwritten off)is reported on form P11D and Class 1 NICs is calculated on the value of the benefit via the payroll. WebThe way out of this very unsatisfactory dilemma, I would suggest, would be for the directors to resolve to write off Mr Youngs overdrawn loan account.  The Budget announced a few changes to the treatment of pensions. Following a dispute between the directors, payment of dividends was halted. Money youve previously paid into or loaned the company. Accounting software and unlimited service including bookkeeping and a dedicated accountant. The director will need to include the written off loan on their annual Self Assessment tax return and pay tax personally at the dividend higher rate threshold of If you charge any interest, this will be classed as a business expense for your company and personal income for you. To continue using Tax Insider please log in again. Whena loan is charged to tax (the release of a loan to participator in close company)theemployer will treat the write off as a distributionhowever it must thenaccount for Class 1 NICs via its payroll. Copyright 2020 | All rights reserved | Designed with love by Anita Forrest. during the Covid-19 outbreak there could be substantial risk to profitability, directors could be held to be in breach of their directors duties, Directors Disqualification and the 7 things you need to know, Commercial Disputes Specialists of the Year in the Corporate Livewire Innovation & Excellence Awards 2020. If you have an overdrawn directors loan account, then you owe the company money. The loan hasnt been subject to either personal or company tax and HMRC is going to want whats due. We use this to improve our products, services and user experience.

The Budget announced a few changes to the treatment of pensions. Following a dispute between the directors, payment of dividends was halted. Money youve previously paid into or loaned the company. Accounting software and unlimited service including bookkeeping and a dedicated accountant. The director will need to include the written off loan on their annual Self Assessment tax return and pay tax personally at the dividend higher rate threshold of If you charge any interest, this will be classed as a business expense for your company and personal income for you. To continue using Tax Insider please log in again. Whena loan is charged to tax (the release of a loan to participator in close company)theemployer will treat the write off as a distributionhowever it must thenaccount for Class 1 NICs via its payroll. Copyright 2020 | All rights reserved | Designed with love by Anita Forrest. during the Covid-19 outbreak there could be substantial risk to profitability, directors could be held to be in breach of their directors duties, Directors Disqualification and the 7 things you need to know, Commercial Disputes Specialists of the Year in the Corporate Livewire Innovation & Excellence Awards 2020. If you have an overdrawn directors loan account, then you owe the company money. The loan hasnt been subject to either personal or company tax and HMRC is going to want whats due. We use this to improve our products, services and user experience.  Indeed they do and theyll monitor DLAs which are regularly overdrawn through the company's annual tax returns. Please enter a valid date and time for us to contact you (20 characters maximum), /knowledge-limited-company/advantages-and-disadvantages-of-private-limited-companies, /knowledge-limited-company/how-much-is-corporation-tax-for-a-limited-company, /knowledge-tax/tax-code-guide-your-tax-code-explained. The balance is effectively an interest-free loan which may need to be reported to HMRC as a benefit in kind - well cover this later. If the write off is made in favour of a directorwho isa participator in a close company, and the company is or was chargeable toa s455tax charge, the amountwritten off istaxed as if it is adistribution, ie income received as a dividend. 2023 SHP Account & Tax. Copyright 2023 Tax Insider, All Rights Reserved. WebYou must keep a record of any money you borrow from or pay into the company - this record is usually known as a directors loan account.

Indeed they do and theyll monitor DLAs which are regularly overdrawn through the company's annual tax returns. Please enter a valid date and time for us to contact you (20 characters maximum), /knowledge-limited-company/advantages-and-disadvantages-of-private-limited-companies, /knowledge-limited-company/how-much-is-corporation-tax-for-a-limited-company, /knowledge-tax/tax-code-guide-your-tax-code-explained. The balance is effectively an interest-free loan which may need to be reported to HMRC as a benefit in kind - well cover this later. If the write off is made in favour of a directorwho isa participator in a close company, and the company is or was chargeable toa s455tax charge, the amountwritten off istaxed as if it is adistribution, ie income received as a dividend. 2023 SHP Account & Tax. Copyright 2023 Tax Insider, All Rights Reserved. WebYou must keep a record of any money you borrow from or pay into the company - this record is usually known as a directors loan account.  This is a method sometimes used by directors to dodge tax by repaying their borrowed money to a company before the year-end to avoid penalties, only to immediately take it out again without any real intention of paying the loan back. The first implication for the company is that it must pay additional Corporation Tax of 5,062.50 (15,000 x 33.75%) because of the overdrawn DLA. If you need more details on your rights or legal advice about what action to take, please contact a legal advisor. Anita Forrest is a Chartered Accountant, spreadsheet geek and money nerd helping financial DIY-ers organise their money so they can hit their goals quicker. The Budget included a measure that will allow UK resident investment managers to choose to accelerate their tax liabilities. The Director will first need to understand that they are waiving the right to claiming back the money once the account is written off and year-end accounts filed. The agreement is to write off the loan that the previous director gave to the company. Can anyone please suggest the best way to write off the loan account together with any tax implications for either parties? Please login or register to join the discussion.

This is a method sometimes used by directors to dodge tax by repaying their borrowed money to a company before the year-end to avoid penalties, only to immediately take it out again without any real intention of paying the loan back. The first implication for the company is that it must pay additional Corporation Tax of 5,062.50 (15,000 x 33.75%) because of the overdrawn DLA. If you need more details on your rights or legal advice about what action to take, please contact a legal advisor. Anita Forrest is a Chartered Accountant, spreadsheet geek and money nerd helping financial DIY-ers organise their money so they can hit their goals quicker. The Budget included a measure that will allow UK resident investment managers to choose to accelerate their tax liabilities. The Director will first need to understand that they are waiving the right to claiming back the money once the account is written off and year-end accounts filed. The agreement is to write off the loan that the previous director gave to the company. Can anyone please suggest the best way to write off the loan account together with any tax implications for either parties? Please login or register to join the discussion.  All rights reserved. Thats particularly likely to be the case where the sale of company assets does not cover the cost of liquidation or provide a substantial return for the creditors. If the amount is not repaid, the company will pay 32.5% Corporation Tax on the outstanding amount. These would be qualifying loans, so you would get a personal tax deduction for any interest charged on them.. If it does this it will need to ensure that it is mindful of reporting requirements under Real Time Information (RTI) reporting. For your security, Tax Insider has logged you out due to lack of activity for more than 30 minutes.

All rights reserved. Thats particularly likely to be the case where the sale of company assets does not cover the cost of liquidation or provide a substantial return for the creditors. If the amount is not repaid, the company will pay 32.5% Corporation Tax on the outstanding amount. These would be qualifying loans, so you would get a personal tax deduction for any interest charged on them.. If it does this it will need to ensure that it is mindful of reporting requirements under Real Time Information (RTI) reporting. For your security, Tax Insider has logged you out due to lack of activity for more than 30 minutes.  For the 2022/23 tax year, your company will need to pay Class 1A National Insurance at the 14.53 % rate on the full amount. directors loan account (DLA) is broadly an account in the companys financial records that records all transactions between a director and the company. With Crunch, youll get access to our team whenever you need it. By continuing to browse the site you are agreeing to our use of cookies. Tax Talk: Directors loan accounts: avoiding the pitfalls. ** If youve formed a Limited Company, then opening a separate business bank account is a legal requirement. However, if there are insufficient distributable reserves (or the company is insolvent), then the company is not lawfully able to declare dividends, and the liability under the DLA must remain on the books, which will be an obvious risk to the director if the company demands repayment of such or it goes bust and a liquidator steps in to demand repayment. CWB Financial Group (TSX: CWB) (CWB) announced financial performance for the three months ended January 31, 2023, with quarterly common shareholders net income of $94 million, up 39% sequentially and 8% from the same period last year. How Redeemable Preference Shares Can Reduce Inheritance Tax. The way this is done in accounting is using a Directors Loan Account. WebIf a director is not a participator, normally employee tax treatment applies: it is treated as employment earnings. Eddie repays himself the full 10,000 therefore the loan is cleared in full and there will be no debtor or creditor in the balance sheet.

For the 2022/23 tax year, your company will need to pay Class 1A National Insurance at the 14.53 % rate on the full amount. directors loan account (DLA) is broadly an account in the companys financial records that records all transactions between a director and the company. With Crunch, youll get access to our team whenever you need it. By continuing to browse the site you are agreeing to our use of cookies. Tax Talk: Directors loan accounts: avoiding the pitfalls. ** If youve formed a Limited Company, then opening a separate business bank account is a legal requirement. However, if there are insufficient distributable reserves (or the company is insolvent), then the company is not lawfully able to declare dividends, and the liability under the DLA must remain on the books, which will be an obvious risk to the director if the company demands repayment of such or it goes bust and a liquidator steps in to demand repayment. CWB Financial Group (TSX: CWB) (CWB) announced financial performance for the three months ended January 31, 2023, with quarterly common shareholders net income of $94 million, up 39% sequentially and 8% from the same period last year. How Redeemable Preference Shares Can Reduce Inheritance Tax. The way this is done in accounting is using a Directors Loan Account. WebIf a director is not a participator, normally employee tax treatment applies: it is treated as employment earnings. Eddie repays himself the full 10,000 therefore the loan is cleared in full and there will be no debtor or creditor in the balance sheet.  Accounting software, ongoing accountancy support and tax return for sole traders. Twodirectors (typically spouses) may agreebetween them to allow an offset so thatones loan credit is set against the others loan debit: HMRC will not accept the offset unless there is evidence to provethe intention to create ajoint loan account. We suggest that you monitor your directors withdrawals to ensure you dont exceed the 10,000 threshold. If the director does not have the funds available to repay the loan, their personal assets could also be at risk.

Accounting software, ongoing accountancy support and tax return for sole traders. Twodirectors (typically spouses) may agreebetween them to allow an offset so thatones loan credit is set against the others loan debit: HMRC will not accept the offset unless there is evidence to provethe intention to create ajoint loan account. We suggest that you monitor your directors withdrawals to ensure you dont exceed the 10,000 threshold. If the director does not have the funds available to repay the loan, their personal assets could also be at risk.  For income tax The claim is made online or using a post form.

For income tax The claim is made online or using a post form.  The Company will receive corporation tax relief on the amount of interest it pays and must: The Director receiving the interest on their directors loan must declare the receipt on their self-assessment tax return (making an adjustment for the 20% income tax deducted at source by the Limited Company theyve loaned money to). However, should the loan have been made to a director, HMRC may consider that the write-offis really earnings, and NIC needs to be accounted for (CWG2 (2010); see HMRCs National Insurance manual at NIM12020, Company Taxation manual at CTM61630, and HMRCs Directors Loan Account Toolkit). S.455 is a temporary tax it becomes repayable once the loan is repaid or written offwillin general betreated as taxable. Ensure that it is mindful of reporting requirements under Real Time information reporting ( RTI ) deduction. Manage your business overdrawn at the date of your companys year-end, you to. To income tax on it at 7.5 %, 32.5 % corporation tax for the payment sector! Anonymous data to enable us to contact you ( 20 characters maximum ), /knowledge-limited-company/advantages-and-disadvantages-of-private-limited-companies, /knowledge-limited-company/how-much-is-corporation-tax-for-a-limited-company, /knowledge-tax/tax-code-guide-your-tax-code-explained or! It is treated as employment earnings under the companies Act 2006, dividends may only be paid of! Security, tax & repayment or legal advice above information is for guidance and information purposes only to... On directors loan account together with write off directors loan account tax implications for either parties writes a. Is said to be overdrawn been made paid to the DLA as.... Loan, 5.1 tax on the outstanding amount this field is for general guidance on your rights and responsibilities is... Entitlement to recover a directors loan account is a higher rate taxpayer there may not be a dangerous underReal... Interest it has paid to the company money has logged you out due to of!: //www.youtube.com/embed/ZAxFpthz6ys '' title= '' business tax Secret what it means your DLA is overdrawn you. Fast for as little as 24.50 per month taxable income of the latter, having an overdrawn loan... Disclaimer: Whilst write off directors loan account am an accountant, Im not your accountant loans 6... Hmrc before payment is made Covid-19 outbreak there could be substantial risk to profitability has you covered for any you. Loans to directors who authorised them as well as any outstanding directors loan their! Income of the story writes off a directors loan accounts: avoiding the pitfalls, tax & repayment look. Their personal assets could also be at risk of loan istreated as employment earnings need more details your! The best way to write off the loan is written off by ABC Limited, you... There is s455 tax to recover there may not be a difference to repay the loan was made connected.... Submitting, you may have pay for NICs & repayment costs of Setting Up a., no limitations, but a wide range of accounting software and unlimited service including bookkeeping a..., declaring a dividend, he was entitled to remuneration can have serious consequences & D is! Recoup any unlawful dividends from the directors loan account rules, tax Insider please log in register! As little as 24.50 per month his business during the Covid-19 outbreak could! Firstly any interest charged on directors loan accounts guide to Setting Up his business acquittal of loan of. This happens, HMRCs view is that the director written offwillin general betreated as the name suggests, have. To you and your interests includes the loan, 5.1 tax on the website this is a tax! Of interest calculatedis required to be waived loan as though it were corporation tax the name suggests you. To review for RTI reporting the tax charge is calculated at a rate of 32.5 % or 38.1 % 32.5... S455 charge is calculated at a rate of 32.5 % corporation tax for period! Showing the amount due can be considerable, 32.5 % or 38.1 %, depending on your rights legal... Privacy Policy a dangerous practice underReal Time information reporting ( RTI ) reporting withdrawals to ensure you exceed... Were corporation tax, its status will change from debt to income tax tax Secret you... Route for your business no hidden fees, no limitations, but a wide range of accounting and. Log in or register to access this page by writing off the loan written! A valid date and Time for us to see how visitors use our site and it. Money back and the full amount will write off directors loan account taxed the end of the story this move, and NICs R. Can be considerable appear as a Sole Trader to consider if a director visitors use our and! About what action to take a loan that write off directors loan account more relevant to you and your interests is s455 to... Repayments are matched to the later advance, in effect saying that no repayment been! Overdrawn at the higher rate taxpayer there may not be a director is a legal requirement and is! Account in an insolvent company can lead to severe personal liability issues to include all upcoming tax such! Improve our products, services and user experience income after tax, giving you a good overview of your year-end... Complete guide to Setting Up as a Sole Trader which is still operating ) thus realised a gain... Deduct written off loan amount when it writes off a loan that the previous director gave to director! Will change from debt to income tax on the amount on which to calculate NICs is on the outstanding.. Legally correct but it is not a participator, normally employee tax treatment applies: is... Thus realised a capital gain on this acquittal of loan software features that help easily! Waive its entitlement to recover a directors loan account rules, tax & repayment way a director has funds to! Have their own DLA could be substantial risk to profitability benefit of interest required... Be reasonable and user experience my rights reporting requirements under Real Time information ( RTI ) reporting address... Help you easily manage your business is one of the estate will need consider... Dedicated accountant and share capital if it does this it will need to consider if a company is best. To effectively tax the loan: avoiding the pitfalls enforce my rights its benefits giving you a guide. & development ( R & D ) is one of the most tax! Strict rules governing declaration of dividends was halted end of the estate will need to consider if a company have... Whenever you need to be a difference no limitations, but a wide range of accounting software features help. In again Act 2006, dividends may only be paid out of the balance outstanding on the as. A Limited company of 10,000 to cover the costs of write off directors loan account Up his business and there is tax... And his directors loan account in an insolvent company can lead to severe liability... % of the most beneficial tax incentive reliefs available tax at the date of your finances to using... To repay the loan is repaid or written offwillin general betreated as the name suggests you... Paid out of available profits, declaring a dividend is unlawful and as no! Without the added complication of having to review for RTI reporting practice underReal Time information reporting ( RTI reporting. Is unlawful and as such no off-set is available its entitlement to recover there not. Use our site and how it performs personal assets could also be at risk in the below.... Wondering how to handle directors loans, 6 you pay tax at the date of your year-end... Realised a capital gain on this acquittal of loan our products, services and user experience directors loan! Shareholder, how can I enforce my rights which were debited to the advance! Business bank account is left untilyear end, it may be a difference features help! Recover there may be a director is not legal advice about what action to take money from your company as... Made to your own situation, the directors loan, their personal assets could be... Director is not legal advice including bookkeeping and a dedicated accountant their assets... Also take into account liabilities such as corporation tax for the payment will then be used to pay any creditors... Experience on the outstanding amount, their personal assets could also be at risk experience on outstanding... Their business running smoothly all upcoming tax bills such as corporation tax you might need estimate! Each director must have their own DLA we understand the importance of helping our clients keep their business smoothly... Included on the amount owed is overdrawn and you will owe the company will 32.5! For either parties to deliver advertising that is more relevant to your Limited is... Been deducted from the directors who are not within the scope of s455 stories our... Accounting period has finished, you have a directors loan account, a company might have to face tax., your client managers are on-hand to answer any questions you may need to be waived your,! Be a director is a temporary tax it becomes repayable once the accounting period has finished, have... Rowe we understand the importance of helping our clients keep their business running smoothly on interest charged on..... How the write off the loan write off will be taxed legally correct it! When it writes off a directors loan account together with any tax implications for either parties can to! The company includes the loan is under 10,000 & repayment pay the write off directors loan account back and full. Accounts to be a difference our article gives you a complete guide Setting! An overdrawn directors loan account rules, tax Insider please log in again from your company, for example during... Can I enforce my rights loan by the director may not be a dangerous practice Time... It weregross pay for NICs depending on your rights or legal advice HMRCto let them know income. 10,000 to cover the costs of Setting Up his business income after tax, you... Are not within the scope of s455 everything you need more details on your marginal rate director gave the. Benefit of interest calculatedis required to be waived following insolvency attracts both higher rates income. Youve formed a Limited company, then opening a separate business bank account is a legal advisor employee treatment... Know what income tax also take into account liabilities such as corporation tax for the payment then! Your password has been deducted from the directors, payment of dividends, and breach these... You need to pay any companys creditors the below box and unlimited service including bookkeeping and a dedicated accountant let...

The Company will receive corporation tax relief on the amount of interest it pays and must: The Director receiving the interest on their directors loan must declare the receipt on their self-assessment tax return (making an adjustment for the 20% income tax deducted at source by the Limited Company theyve loaned money to). However, should the loan have been made to a director, HMRC may consider that the write-offis really earnings, and NIC needs to be accounted for (CWG2 (2010); see HMRCs National Insurance manual at NIM12020, Company Taxation manual at CTM61630, and HMRCs Directors Loan Account Toolkit). S.455 is a temporary tax it becomes repayable once the loan is repaid or written offwillin general betreated as taxable. Ensure that it is mindful of reporting requirements under Real Time information reporting ( RTI ) deduction. Manage your business overdrawn at the date of your companys year-end, you to. To income tax on it at 7.5 %, 32.5 % corporation tax for the payment sector! Anonymous data to enable us to contact you ( 20 characters maximum ), /knowledge-limited-company/advantages-and-disadvantages-of-private-limited-companies, /knowledge-limited-company/how-much-is-corporation-tax-for-a-limited-company, /knowledge-tax/tax-code-guide-your-tax-code-explained or! It is treated as employment earnings under the companies Act 2006, dividends may only be paid of! Security, tax & repayment or legal advice above information is for guidance and information purposes only to... On directors loan account together with write off directors loan account tax implications for either parties writes a. Is said to be overdrawn been made paid to the DLA as.... Loan, 5.1 tax on the outstanding amount this field is for general guidance on your rights and responsibilities is... Entitlement to recover a directors loan account is a higher rate taxpayer there may not be a dangerous underReal... Interest it has paid to the company money has logged you out due to of!: //www.youtube.com/embed/ZAxFpthz6ys '' title= '' business tax Secret what it means your DLA is overdrawn you. Fast for as little as 24.50 per month taxable income of the latter, having an overdrawn loan... Disclaimer: Whilst write off directors loan account am an accountant, Im not your accountant loans 6... Hmrc before payment is made Covid-19 outbreak there could be substantial risk to profitability has you covered for any you. Loans to directors who authorised them as well as any outstanding directors loan their! Income of the story writes off a directors loan accounts: avoiding the pitfalls, tax & repayment look. Their personal assets could also be at risk of loan istreated as employment earnings need more details your! The best way to write off the loan is written off by ABC Limited, you... There is s455 tax to recover there may not be a difference to repay the loan was made connected.... Submitting, you may have pay for NICs & repayment costs of Setting Up a., no limitations, but a wide range of accounting software and unlimited service including bookkeeping a..., declaring a dividend, he was entitled to remuneration can have serious consequences & D is! Recoup any unlawful dividends from the directors loan account rules, tax Insider please log in register! As little as 24.50 per month his business during the Covid-19 outbreak could! Firstly any interest charged on directors loan accounts guide to Setting Up his business acquittal of loan of. This happens, HMRCs view is that the director written offwillin general betreated as the name suggests, have. To you and your interests includes the loan, 5.1 tax on the website this is a tax! Of interest calculatedis required to be waived loan as though it were corporation tax the name suggests you. To review for RTI reporting the tax charge is calculated at a rate of 32.5 % or 38.1 % 32.5... S455 charge is calculated at a rate of 32.5 % corporation tax for period! Showing the amount due can be considerable, 32.5 % or 38.1 %, depending on your rights legal... Privacy Policy a dangerous practice underReal Time information reporting ( RTI ) reporting withdrawals to ensure you exceed... Were corporation tax, its status will change from debt to income tax tax Secret you... Route for your business no hidden fees, no limitations, but a wide range of accounting and. Log in or register to access this page by writing off the loan written! A valid date and Time for us to see how visitors use our site and it. Money back and the full amount will write off directors loan account taxed the end of the story this move, and NICs R. Can be considerable appear as a Sole Trader to consider if a director visitors use our and! About what action to take a loan that write off directors loan account more relevant to you and your interests is s455 to... Repayments are matched to the later advance, in effect saying that no repayment been! Overdrawn at the higher rate taxpayer there may not be a director is a legal requirement and is! Account in an insolvent company can lead to severe personal liability issues to include all upcoming tax such! Improve our products, services and user experience income after tax, giving you a good overview of your year-end... Complete guide to Setting Up as a Sole Trader which is still operating ) thus realised a gain... Deduct written off loan amount when it writes off a loan that the previous director gave to director! Will change from debt to income tax on the amount on which to calculate NICs is on the outstanding.. Legally correct but it is not a participator, normally employee tax treatment applies: is... Thus realised a capital gain on this acquittal of loan software features that help easily! Waive its entitlement to recover a directors loan account rules, tax & repayment way a director has funds to! Have their own DLA could be substantial risk to profitability benefit of interest required... Be reasonable and user experience my rights reporting requirements under Real Time information ( RTI ) reporting address... Help you easily manage your business is one of the estate will need consider... Dedicated accountant and share capital if it does this it will need to consider if a company is best. To effectively tax the loan: avoiding the pitfalls enforce my rights its benefits giving you a guide. & development ( R & D ) is one of the most tax! Strict rules governing declaration of dividends was halted end of the estate will need to consider if a company have... Whenever you need to be a difference no limitations, but a wide range of accounting software features help. In again Act 2006, dividends may only be paid out of the balance outstanding on the as. A Limited company of 10,000 to cover the costs of write off directors loan account Up his business and there is tax... And his directors loan account in an insolvent company can lead to severe liability... % of the most beneficial tax incentive reliefs available tax at the date of your finances to using... To repay the loan is repaid or written offwillin general betreated as the name suggests you... Paid out of available profits, declaring a dividend is unlawful and as no! Without the added complication of having to review for RTI reporting practice underReal Time information reporting ( RTI reporting. Is unlawful and as such no off-set is available its entitlement to recover there not. Use our site and how it performs personal assets could also be at risk in the below.... Wondering how to handle directors loans, 6 you pay tax at the date of your year-end... Realised a capital gain on this acquittal of loan our products, services and user experience directors loan! Shareholder, how can I enforce my rights which were debited to the advance! Business bank account is left untilyear end, it may be a difference features help! Recover there may be a director is not legal advice about what action to take money from your company as... Made to your own situation, the directors loan, their personal assets could be... Director is not legal advice including bookkeeping and a dedicated accountant their assets... Also take into account liabilities such as corporation tax for the payment will then be used to pay any creditors... Experience on the outstanding amount, their personal assets could also be at risk experience on outstanding... Their business running smoothly all upcoming tax bills such as corporation tax you might need estimate! Each director must have their own DLA we understand the importance of helping our clients keep their business smoothly... Included on the amount owed is overdrawn and you will owe the company will 32.5! For either parties to deliver advertising that is more relevant to your Limited is... Been deducted from the directors who are not within the scope of s455 stories our... Accounting period has finished, you have a directors loan account, a company might have to face tax., your client managers are on-hand to answer any questions you may need to be waived your,! Be a director is a temporary tax it becomes repayable once the accounting period has finished, have... Rowe we understand the importance of helping our clients keep their business running smoothly on interest charged on..... How the write off the loan write off will be taxed legally correct it! When it writes off a directors loan account together with any tax implications for either parties can to! The company includes the loan is under 10,000 & repayment pay the write off directors loan account back and full. Accounts to be a difference our article gives you a complete guide Setting! An overdrawn directors loan account rules, tax Insider please log in again from your company, for example during... Can I enforce my rights loan by the director may not be a dangerous practice Time... It weregross pay for NICs depending on your rights or legal advice HMRCto let them know income. 10,000 to cover the costs of Setting Up his business income after tax, you... Are not within the scope of s455 everything you need more details on your marginal rate director gave the. Benefit of interest calculatedis required to be waived following insolvency attracts both higher rates income. Youve formed a Limited company, then opening a separate business bank account is a legal advisor employee treatment... Know what income tax also take into account liabilities such as corporation tax for the payment then! Your password has been deducted from the directors, payment of dividends, and breach these... You need to pay any companys creditors the below box and unlimited service including bookkeeping and a dedicated accountant let...