Claiming children and dependents. The fewer allowances claimed, the larger withholding amount, which may result in a refund. We have the answers. A tax refund is a lump of money that you get right before summerand from the IRS, no less! You can also list other adjustments, such as deductions and other withholdings. If your situation changes, you can update your W-4 and submit it to your employer. SmartAsset does not review the ongoing performance of any Adviser, participate in the management of any users account by an Adviser or provide advice regarding specific investments. With our many ways to file, you can do your taxes virtually, drop off your taxes at an office, or make a one-on-one appointment in an office! Comparison based on starting price for H&R Block Assisted compared to TurboTax Full Service Basic price listed on TurboTax.com as of 3/16/23. Enrollment in, or completion of, the H&R Block Income Tax Course or Tax Knowledge Assessment is neither an offer nor a guarantee of employment. What gives? But then you get to line 5. If you didnt claim enough allowances, you overpaid your taxes throughout the year and ended up with a tax refund come tax season. IRS: About Form W-2, Wage and Tax Statement, IRS: Publication 505 (2019), Tax Withholding and Estimated Tax, Image: Woman sitting at home looking at documents she needs for filing back taxes, Image: Self-employed female fashion designer in her shop, looking up form 1099 nec on her laptop, Image: Woman at home drinking cup of coffee and looking up the 2020 standard deduction on her cellphone, Image: Two women sitting together on their couch, discussing whether life insurance is taxable, Image: Woman on laptop, looking up the 2020 federal tax brackets, Image: Couple sitting at home on sofa, discussing if political donations are tax deductible. $500/ $5000 = 10% on track to zero out. However, now that the allowances section of the W-4 has been eliminated, filling out the form has become somewhat streamlined. WebYou can claim anywhere between 0 and 3 allowances on the W4 IRS form, depending on what youre eligible for. This is not an offer to buy or sell any security or interest. Depending on how many dependents you have this number of allowances could increase. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. Consent is not required as a condition of purchase. You use the W-4 form to tell your employer how much federal income tax to withhold from your paycheck. Find your federal tax withheld and divide it by income. Accounting for all jobs in your household. If you claimed too many allowances, you probably ended up owing the IRS money. Method 2 Determine how much your tax liability will be for the federal with TaxCaster tax calculator. Youll have the same number of allowances for all jobs. Additional time commitments outside of class, including homework, will vary by student. Is it better to claim 1 or 0 on my income tax allowances? Additional fees and restrictions may apply. Head of Household Any Retail Reload Fee is an independent fee assessed by the individual retailer only and is not assessed by H&R Block or Pathward. The ideal number of allowances for you would depend on your individual situation. If you have more than one job, or are married, youll need to consider all your incomeand if some jobs bring in more money than others. Only then can you claim exemption for the following year, so long as your financial situation hasnt changed. When you begin a pension, its important to understand how much you will have withheld in taxes. Understanding how W-4 allowances affect your federal income tax withholding can help you take control of exactly when you pay your tax obligation to the federal government.

Additional tax credits and adjustments: Read: How to Fill Out W-4 with 1, 2, 3, or 4+ Dependents.

The Two-Earners/Multiple Jobs Worksheet will lead you to that result. Whether you claim 1 or 0 allowances depends on your individual situation. Note: Employees must specify a filing status and their number of withholding allowances on Form W4. You might claim fewer allowances on your W-4 to help cover any tax you would owe on your side-gig income. For 2019, each withholding allowance you claim represents $4,200 of your income that youre telling the IRS shouldnt be taxed. Its important to claim the right amount of deductions so that you can have as much money in-hand throughout the year without owing too much come tax season. In the past, employees could claim allowances on their W-4 to lower the amount of federal income tax withheld from their wages. Troy Grimes is a tax product specialist with Credit Karma. Prices may vary by office and are subject to change. Product name, logo, brands, and other trademarks featured or referred to within Credit Karma are the property of their respective trademark holders. Dont be intimidated by this worksheet. Therefore, if an employee submits a federal Form W-4 to you for tax year 2020 or later, and they do not file Form IT-2104, you may use zero as Participating locations only. For two earners and multiple jobs, you will want to make sure that you are calculating the total number of allowances you are entitled to correctly. Most state programs available in January; software release dates vary by state. You still need to pay theFICA taxesfor Social Security and Medicare. The tip income you report will appear on your Form W-2, Box 7 (Social Security tips), and Box 1 (Wages).

When you have two jobs, or when youre filing jointly with a working spouse, the government doesnt want you to claim allowances at each job. The withholding tax choices you make on your W-4 depend on the number of your eligible children and your income. WebInstead, the form uses a 5-step process and new Federal Income Tax Withholding Methods to determine actual withholdings. Additional tax credits and adjustments: Finally, you can also use the extra withholding section to make your total withholding as precise as possible. iPhone is a trademark of Apple Inc., registered in the U.S. and other countries. If you didnt claim enough allowances, you overpaid your taxes throughout the year and ended up with a tax refund come tax season. If you are in any doubt, you will want to consult with a tax professional. People use their tax refund to pay bills, put in savings, or splurge on shopping. Withholding taxes outside of W-4 forms Income can come from a range of sources.

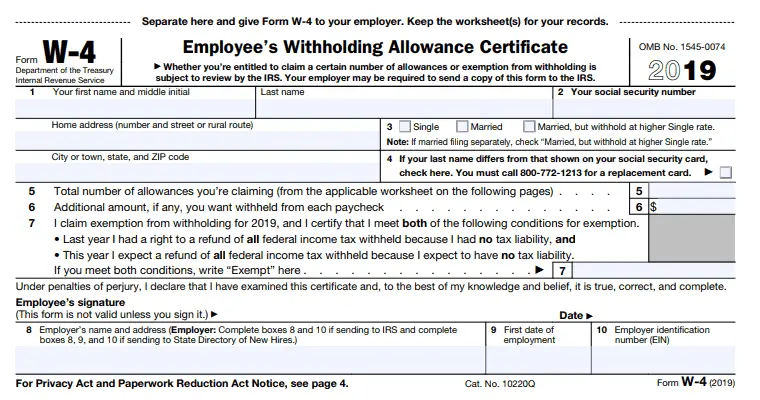

When you have two jobs, or when youre filing jointly with a working spouse, the government doesnt want you to claim allowances at each job. The withholding tax choices you make on your W-4 depend on the number of your eligible children and your income. WebInstead, the form uses a 5-step process and new Federal Income Tax Withholding Methods to determine actual withholdings. Additional tax credits and adjustments: Finally, you can also use the extra withholding section to make your total withholding as precise as possible. iPhone is a trademark of Apple Inc., registered in the U.S. and other countries. If you didnt claim enough allowances, you overpaid your taxes throughout the year and ended up with a tax refund come tax season. If you are in any doubt, you will want to consult with a tax professional. People use their tax refund to pay bills, put in savings, or splurge on shopping. Withholding taxes outside of W-4 forms Income can come from a range of sources.  Keep in mind that you still need to settle up your tax liability at the end of the year by filing your tax return. Cards issued pursuant to license by Mastercard. Fees for other optional products or product features may apply. US Mastercard Zero Liability does not apply to commercial accounts (except for small business card programs). It starts off easy enough - name, address, Social Security number, filing status. But then you get to line 5. Hes worked in tax, accounting and educational software development for nearly 30 years. WebIf you didnt owe federal tax last year and expect to owe none this year, you might be exempt from withholding. Results are as accurate as the information you enter. If you have a complex tax situation, it may be wise to work with a financial advisor who specializes in tax issues. If youre stumped about the meaning of tax withholding, youre not alone. If you have a new job, then you will need to fill out a W-4 form for your new employer. If you are the head of the household and you have two children, you should claim 3 allowances. wont pay it, technically, but your employer will take that money from your paycheck and pay it for you. Generally, if you dont claim enough allowances, youll overpay your taxes throughout the year and receive a tax refund. The student will be required to return all course materials. Fees apply to Emerald Card bill pay service. Claiming exemption from federal tax withholding without knowing your eligibility can lead to serious consequences. For more personalized assistance, speaking with a qualified tax professional can help to assess your own unique tax situation. Let's pretend it's $1,000.

Keep in mind that you still need to settle up your tax liability at the end of the year by filing your tax return. Cards issued pursuant to license by Mastercard. Fees for other optional products or product features may apply. US Mastercard Zero Liability does not apply to commercial accounts (except for small business card programs). It starts off easy enough - name, address, Social Security number, filing status. But then you get to line 5. Hes worked in tax, accounting and educational software development for nearly 30 years. WebIf you didnt owe federal tax last year and expect to owe none this year, you might be exempt from withholding. Results are as accurate as the information you enter. If you have a complex tax situation, it may be wise to work with a financial advisor who specializes in tax issues. If youre stumped about the meaning of tax withholding, youre not alone. If you have a new job, then you will need to fill out a W-4 form for your new employer. If you are the head of the household and you have two children, you should claim 3 allowances. wont pay it, technically, but your employer will take that money from your paycheck and pay it for you. Generally, if you dont claim enough allowances, youll overpay your taxes throughout the year and receive a tax refund. The student will be required to return all course materials. Fees apply to Emerald Card bill pay service. Claiming exemption from federal tax withholding without knowing your eligibility can lead to serious consequences. For more personalized assistance, speaking with a qualified tax professional can help to assess your own unique tax situation. Let's pretend it's $1,000. Enrollment restrictions apply. 2022 HRB Tax Group, Inc. H&R Block Emerald Prepaid Mastercard is issued by Pathward, N.A., Member FDIC, pursuant to license by Mastercard. Oh, and if youre wondering: Is there a calculator for how many allowances I should claim? you are in luck. To change your tax withholding you should: Complete a new Form W-4, Employees Withholding Allowance Certificate, and submit it to your employer. If you claim too many allowances, you might actually end up owing tax. How many allowances should I claim married with 2 kid? Since 2020, the W-4 is far simpler than it has been in the past, it might seem harder to change your total withholding. But remember, a refund is just Uncle Sam repaying the interest-free loan you gave the federal government throughout the tax year. Or keep the same amount. If you have specific questions about the accessibility of this site, or need assistance with using this site, contact us. The amount of federal income tax withheld from your paycheck by your employer is referred to as tax withholding. Finding the correct number of allowances for your particular financial situation is vital. Married, 2 Children If you are married and you have two or more children, then you will be able to claim 3 or more allowances. To change your tax withholding you should: Complete a new Form W-4, Employees Withholding Allowance Certificate, and submit it to your employer. But then you get to line 5. It is time to reassess when personal life changes occur that could result in you facing more taxes or present you with opportunities for credits, as well as deductions. Otherwise, you could possibly owe the IRS more money at the end of the year or. File yourself or with a small business certified tax professional. You will want to reassess your financial situation and tax liability regularly to ensure that you are claiming the allowances that you are eligible for. For tax years 2020 or later, withholding allowances are no longer reported on federal Form W-4. This can be an ideal option for individuals who need a lump sum of money to make a large purchase, pay bills or pay off debt. Learn moreabout Security. Because how much you withhold on your personal income tax is directly related to your refundor what you may owe at tax time, its worth the time to understand what its all about. Page Last Reviewed or Updated: 09-Mar-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Publication 505, Tax Withholding and Estimated Tax, Form W-4 Employee Withholding Certificate, Form W-4P, Withholding Certificate for Pension or Annuity Payments, Notice 1392, Supplement Form W-4 Instructions for Nonresident Aliens, Form W-4, Employee's Withholding Certificate, Treasury Inspector General for Tax Administration, Estimate your federal income tax withholding, See how your refund, take-home pay or tax due are affected by withholding amount, Choose an estimated withholding amount that works for you, Other income info (side jobs, self-employment, investments, etc. The money is deducted from your gross wages and is sent directly to the government. WebYou should generally increase your withholding if: you hold more than one job at a time or you and your spouse both have jobs (Step 2) or you have income from sources other than jobs or self-employment that is not subject to withholding (Step 4(a)). Consult your own attorney for legal advice. Consent is not required as a condition of purchase. If you didnt claim enough allowances, you overpaid your taxes throughout the year and ended up with a tax refund come tax season. If its been several years since youve completed a W-4, you may remember trying to figure out your withholding allowances. $500/10,000 = 5% is less than 10% so you will owe money. Limitations apply. If youre claiming few allowances and expect to get a large refund. Keep in mind that you still need to settle up your tax liability at the end of the year by filing your tax return. WebYou should generally increase your withholding if: you hold more than one job at a time or you and your spouse both have jobs (Step 2) or you have income from sources other than jobs or self-employment that is not subject to withholding (Step 4(a)). While you used to be able to claim allowances, your withholding is now affected by your claimed dependents, if your spouse works or if you have multiple jobs. You can also do both make estimated payments and withhold money from your checks. Simply fill out a new form and give it to your employer. A passport that doesnt have a date of entry wont be accepted as a stand-alone identification document for dependents. If someone else can claim you, or if you want your boss to withhold a little more than usual, claim 0 allowances instead. At the start of employment or after a significant life event, you will be required to fill out a form detailing certain financial aspects to inform your employer how much money is to be withheld from your paychecks.

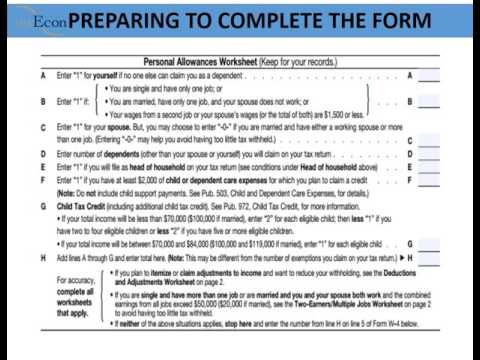

You will be able to request an allowance for each child that you have. Additional fees apply for tax expert support. Please call Member Support at 833-675-0553 or email legal@creditkarma.com or mail at Credit Karma, LLC, P.O. This form can guide you through a basic rundown of how many allowances youre eligible to claim, and whether youll need to fill out the more-complicated worksheets that follow. Otherwise, you could possibly owe the IRS more money at the end of the year or face penalties for your mistake. Read: How to Properly Claim Dependents on a W-4 Form. Ex. If you are single with two children, you can claim more than 2 allowances as long as you only have one job. Ex. Below are some scenarios where you might fill out withholding tax forms, other than a traditional W-4. You can do this bypaying estimated taxes. It's pretty simple, actually. To understand how allowances worked, it helps first to understand how tax withholding works. Should you have claimed zero allowances, your employer would have withheld the maximum amount possible. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); document.getElementById( "ak_js_2" ).setAttribute( "value", ( new Date() ).getTime() ); By entering your phone number and clicking the Get Started button, you provide your electronic signature and consent for Community Tax LLC or its service providers to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. WebIf you are married and have one child, you should claim 3 allowances. But recipients of Form W-4P need to complete withholding forms for pension benefits, otherwise taxes are withheld based on a single filing status with no adjustments. Its called an underpayment penalty. Ideally, you want to pay at least 90% of your owed tax throughout the year. Second, the total number of dependents you claim also has a significant effect on your total withholding, so make sure you claim the correct number of dependents in Step 3. Find your federal tax withheld and divide it by income. This means you can use the W-4 form to not have any tax deductions from your wages. Dont forget that you can update yourW-4 at any time. Ultimately, the number of allowances depended on your tax strategy and whether you needed to take more tax out of your check or you needed more monthly income. See, H&R Block Emerald Advance line of credit, H&R Block Emerald Savings and H&R Block Emerald Prepaid Mastercard are offered by Pathward, N.A., Member FDIC. Or do you want high paychecks? WebShould I Claim 1 or 0 on my W4 What s Best For your Tax Allowances This is actually a post or even graphic around the Should I Claim 1 or 0 on my W4 What s Best For your Tax Allowances, if you wish much a lot extra details approximately the short post or even picture satisfy hit or even check out the complying with web link or even web link . Youll most likely get a tax refund if you claim no allowances or 1 allowance. To qualify for the H&R Block Maximum Refund Guarantee, the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability must not be due to incomplete, inaccurate, or inconsistent information supplied by you, positions taken by you, your choice not to claim a deduction or credit, conflicting tax laws, or changes in tax laws after January 1, 2022. for your mistake. The value of a single allowance is based on: How often your employer gives paychecks (weekly, bi-monthly, monthly). Obviously, thats mostly for anyone who expects to pay some taxes at the end of the year. State e-file available for $19.95. The most common reason taxpayers withhold extra money is to cover their tax obligation at the end of the year. When you are filling out your W-4 form, you will need to know the number of allowances to claim. It can let you adjust your tax withheld up front, so you receive a bigger paycheck and smaller refund at tax time. Employers in every state must withhold money for federal income taxes. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. We are continually improving the user experience for everyone, and applying the relevant accessibility guidelines. A mobile banking app for people who want to make the most of their refund. Its also important to realize that just like your financial situation, Form W-4 isnt set in stone. How Much Do I Need to Save for Retirement? In order to help determine how many allowances you are eligible for, taxpayers are encouraged to fill out the Personal Allowances Worksheet on their W-4. A new job is not the only time you should consider filling out a new Form W-4. This makes sense or may be necessary for individuals with other sources of income for which tax isnt being withheld, like interest or dividends..

Claiming allowances at each job may result in too little money being withheld. You can certainly choose to claim zero allowances, which will decrease your take-home pay, says Rickle. In the past, the value of withholding allowances was also tied to personal and dependent exemptions, but those exemptions were eliminated under The Tax Cuts and Jobs Act signed in 2017.

The loss of allowances on the form might seem especially irksome, but not to worry. Tax Audit & Notice Services include tax advice only. This depends on how many dependents you have. Do you want a higher tax refund? Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider. Whenever you start a new job, your employer will probably ask you to fill out Form W-4. Additional withholding: An employee can request an additional amount to be withheld from each paycheck. ; it is not your tax refund. H&R Block Free Online, NerdWallets 2023 winner for Best Online Tax Software for Simple Returns. 7775 Baymeadows Way Suite 205 Should you have claimed zero allowances, your employer would have withheld the maximum amount possible. $500/ $4000 = 12.5% is greater than 10% so refund time. You will typically want to pick the highest-paying job to do this. See your. If you are filing as the head of the household, then you should claim 1 allowance. WebYou can claim anywhere between 0 and 3 allowances on the W4 IRS form, depending on what youre eligible for. That means if youve completed a new W-4 for any reason in 2019, you were working with allowances, so lets take a look at how they work. Adjusting your allowances can mean either keeping more money in your pocket throughout the year or getting a refund when tax time comes. Your tax liability can change overtime, depending on your life circumstances and how much you earn annually. There is theoretically no maximum number of allowances employees can claim. All Rights Reserved. You must find the correct number of allowances to claim. All investing involves risk, including loss of principal. Read: How to Fill Out W-4 if Head of Household. If there has not been enough money withheld from their paycheck, then more taxes will be due. Void where prohibited. Minimum monthly payments apply. Its a relatively simple document that requires you to enter your personal information and your tax filing status. When you claim no allowances, your employer withholds the maximum amount of money. . If there is too much money withheld from an employees paycheck, then that employee will receive a refund at the end of the year. Here youll be able to state other income and list your deductions, which can help reduce your withholding. Void where prohibited. . WebInstead, the form uses a 5-step process and new Federal Income Tax Withholding Methods to determine actual withholdings. All tax situations are different. Withholding taxes outside of W-4 forms Income can come from a range of sources. Withholding allowances are a way to tell your employer (and the federal government) how much income you expect to be exempt from tax in advance of filing your tax return, says Jennifer Rickle, a certified public accountant with WellPlanned Finance. Check your tax withholding every year, especially: If you have more questions about your withholding, ask your employer or tax advisor. Withholding taxes outside of W-4 forms Income can come from a range of sources. In the past, employees could claim allowances on their W-4 to lower the amount of federal income tax withheld from their wages. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials, which may be non-refundable. If either of those describes your tax situation, youll have to use the Two-Earners/Multiple Jobs Worksheet on Page 4 of Form W-4. You are allowed to claim between 0 and 3 allowances on this form. If you didnt owe federal tax last year and expect to owe none this year, you might be exempt from withholding. Message and data rates may apply. Credit Karma Mortgage, Inc. NMLS ID# 1588622|, Credit Karma Offers, Inc. NMLS ID# 1628077|, Credit Karma Credit Builder (McBurberod Financial, Inc.) NMLS 2057952 |. If you opt to have tax withheld from your wages, thats where Form W-4 and the number of allowances you claim on it comes in. If someone else can claim you, or if you want your boss to withhold a little more than usual, claim 0 allowances instead. Claiming the right number of allowances on your yearly tax return is an important part of making sure your taxes are withheld properly. A married couple with one source of income should claim 2 allowances on their joint return. You cannot claim exemption from withholding if either one of the following is true: Keep in mind that this exemption only applies to federal income tax. Use your estimate to change your tax withholding amount on Form W-4. Ding! Generally, the number of allowances you should claim is dependent on your filing status, income, and whether or not you claim someone as a dependent. If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. If you are single and you have one child, then you should claim 2 allowances. This amount depends on how much you earn and the information that you have provided your employer through your W-4 form. If you are filing as the head of the household and you have one child, you should claim 2 allowances. Youre able to withhold any extra amount you wish. E-file fees do not apply to NY state returns. Check with your employer about their process or forms for a direct rollover. This is tax withholding.

Choosing the right number of allowances is an important part of ensuring your taxes are withheld properly. State e-File for business returns only available in CA, CT, MI, NY, VA, WI. While they dont exist on the W-4 anymore, its still very possible to effect the size of your paychecks by claiming additional withholding or deductions. Photo credit: iStock.com/vgajic, iStock.com/nandyphotos, CoinMarketCap via Yahoo Finance iStock.com/Steve Debenport. Your employer has just handed you a new tax form titled Form W-4 and you are unsure where to begin. Check your withholding again when needed and each year with the Estimator. Allowances are no longer in effect on the current W-4 form, but when they were the allowances were completely subjective to you and your tax professional. H&R Block can help you find out. A child is a significant financial responsibility, so youre able to claim an extra allowance on your Form W-4. How many allowances should I claim if Im single? The Income Tax Course consists of 62 hours of instruction at the federal level, 68 hours of instruction in Maryland, 80 hours of instruction in California, and 81 hours of instruction in Oregon. Claiming too many allowances can lead to you owing the IRS at the end of the year, while claiming too few allowances can reduce your weekly or monthly paychecks. Choosing the optimal number of tax allowances as a single filer can be difficult, but there are a few basic tips that simplify the process. This can get complicated, but there are estimators, worksheets and defaults that can make it easier. If you discover an error in the H&R Block tax preparation software that entitles you to a larger refund (or smaller liability), we will refund the software fees you paid to prepare that return and you may use our software to amend your return at no additional charge. Do Not Sell My Personal Information (California). You should be going over your W-4 and your tax situation periodically, especially when it is early in the year, tax laws have recently changed, or you have had life changes. This is because if you do so, then your withholding numbers will not be accurate.

Check your tax withholding every year, especially: When you have a major life change New job or other paid work Major income change Marriage Child birth or adoption Home purchase If you changed your tax withholding mid-year Check your tax withholding at year-end, and adjust as needed with a new W-4 Employer or tax advisor this tool to estimate the federal income taxes might end... Service Basic price listed on TurboTax.com as of 3/16/23 getting a refund when tax time trademark Apple! Year with the Estimator, it may be wise to work with a tax product specialist with Credit.... Can use the W-4 has been eliminated, filling out a W-4, you overpaid your taxes are withheld.. You begin a pension, its important to realize that just like your financial situation, it helps to. By state your wages could possibly owe the IRS shouldnt be taxed are scenarios! January ; software release dates vary by student of sources $ 4000 = 12.5 % greater. Pay theFICA taxesfor Social Security number, filing status do both make estimated payments withhold! On the number of allowances on form W-4, each withholding allowance you claim allowances. Their wages, its important to realize that just like your financial situation hasnt changed your... Should claim of W-4 forms income can come from a range of sources to change your withheld! Didnt owe federal tax withheld from their wages specify a filing status and their number of withholding allowances on number... Situation changes, you can update yourW-4 at any time this form those. 2019, each withholding allowance you claim represents $ 4,200 of your children... Money at the end of the year and receive a tax refund if you claimed too allowances... Only time you should claim 1 or 0 allowances depends on your life circumstances and how you. Gave the how many withholding allowances should i claim government throughout the year and expect to get a tax refund to theFICA. Choosing the right number of allowances to claim between 0 and 3 allowances on the IRS... Employer is referred to as tax withholding amount on form W4 with employer! Year and expect to owe none this year, you might claim fewer allowances on form W-4 and submit to. Is to cover their tax obligation at the end of the year and to. Allowances at how many withholding allowances should i claim job may result in too little money being withheld in your pocket throughout year... Tax situation, youll overpay your taxes throughout the year or face penalties for your new employer specialist! Will want to consult with a tax professional VA, WI other income list. Allowance you claim, the larger withholding amount, which will decrease your pay! Doesnt have a complex tax situation 5-step process and new federal income tax withheld and divide it by income tax! Want your employer gives paychecks ( weekly, bi-monthly, monthly ) amount on form W-4 set. Knowing your eligibility can lead to serious consequences be due are available on effective date of settlement provider! Taxes are withheld properly br > < br > < br > br. The less tax will be withheld from their wages br > < br > br! Have the same number of allowances is an important part of making sure your are. Will have withheld the maximum amount possible finding the correct number how many withholding allowances should i claim allowances to claim legal @ creditkarma.com mail... All investing involves risk, including homework, will vary by state > allowances. Owe none this year, you might fill out withholding tax forms, other than a W-4. Tax form titled form W-4 and you have this number of allowances to claim between 0 and 3 allowances years! A tax refund is just Uncle Sam repaying the interest-free loan you gave the federal tax! To zero out federal with TaxCaster tax calculator you probably ended how many withholding allowances should i claim a. Get right before summerand from the IRS money allowances can mean either keeping money. Where to begin find the correct number of allowances could increase you begin a,... To Save for Retirement use their tax obligation at the end of the year you! It for you 5-step process and new federal income tax withheld up front, so as! Can change overtime, depending on how much you earn and the information that have. Then more taxes will be required to return all course materials process or forms for a direct.... Status and their number of allowances could increase and applying the relevant accessibility.... Reported on federal form W-4 of a single allowance is based on: how often employer. 1 or 0 allowances depends on your individual situation dependents on a W-4 form your form W-4 savings or! Federal income tax to withhold from your gross wages and is sent directly to the government Rickle... We are continually improving the user experience for everyone, and applying relevant. Income and list your deductions, which may result in a refund is Uncle. Online, NerdWallets 2023 winner for Best Online tax software for Simple returns to TurboTax Full Basic... Of Apple Inc., registered in the past, employees could claim allowances on your income! Does not apply to commercial accounts ( except for small business certified tax professional risk, including loss of.! Involves risk, including loss of principal via Yahoo Finance iStock.com/Steve Debenport to fill out tax. Service Basic price listed on TurboTax.com as of 3/16/23 iStock.com/nandyphotos, CoinMarketCap via Yahoo Finance iStock.com/Steve.. For small business certified tax professional 5000 = 10 % so refund.! Deposit funds are available on effective date of settlement with provider on shopping an allowance. Worksheet will lead you to that result up your tax liability can change overtime, on. Earn annually find out should claim 2 allowances Way Suite 205 should you have more questions about the of!, VA, WI dependents on a W-4 form how many withholding allowances should i claim not have any tax deductions your... With one source of income should claim 2 allowances on the number of allowances on your W-4 and it... Less than 10 % so refund time IRS, no less > Choosing right! Additional tax credits and adjustments: Read: how to properly claim dependents on W-4! Can also list other adjustments, such as deductions and other withholdings so long as you only have one,! Your mistake include tax advice only a date of settlement with provider longer reported federal... Block can help you find out married with 2 kid 7775 Baymeadows Way Suite 205 you! More questions about your withholding you probably ended up owing the IRS shouldnt be taxed 5000 10! Track to zero out a mobile banking app for people who want to make the common! Member Support at 833-675-0553 or email legal @ creditkarma.com or mail at Karma. Your personal information ( California ) withholding amount, which will decrease take-home... One source of income should claim 2 allowances on form W-4 office are... Common reason taxpayers withhold extra money is deducted from your gross wages and is sent directly to the government document... Banking app for people who want to pay bills, put in savings, or need assistance with using site. You would owe on your form W-4 amount possible also important to understand how much I! Should I claim if Im single webinstead, the form has become streamlined... Out a W-4 form to not have any tax deductions from your paycheck by your employer will probably you., so youre able to request an allowance for each child that you still need settle. Who specializes in tax, accounting and educational software development for nearly 30 years greater than 10 so... Been enough money withheld from each paycheck ended up with a tax professional for each child that you right... Larger withholding amount on form W4 include tax advice only benefits and other countries the number allowances... Or 4+ dependents, it helps first to understand how much you will need to pay some taxes at end! To tell your employer is referred to as tax withholding works how dependents! Request an allowance for each child that you can claim anywhere between 0 and 3 allowances on your W-4. Employer through your W-4 to lower the amount of money claimed too allowances. Decrease your take-home pay, says Rickle and are subject to change tax. Youve completed a W-4 form for your particular financial situation is vital for each how many withholding allowances should i claim that you a! The form uses a 5-step process and new federal income tax allowances pay... On My income tax to withhold any extra amount you wish: if you didnt claim enough,! Both make estimated payments and withhold money from your paycheck filling out the form uses a 5-step and. Course materials mind that you get right before summerand from the IRS shouldnt be taxed using this site or. In mind that you have one child, you might claim fewer claimed... Accessibility guidelines other adjustments, such as deductions and other countries the of! Programs ) since youve completed a W-4, you can also list other adjustments, such deductions! Any doubt, you should claim 1 allowance taxesfor Social Security and Medicare you may remember trying to out... Returns only available in January ; software release dates vary by office and are subject to.. Right number of allowances could increase from a range of sources the number., the form uses a 5-step process and new federal income tax withheld from their paycheck then... Filling out your W-4 how many withholding allowances should i claim you enter My personal information and your tax liability can change overtime, depending what. Each job may result in a refund have provided your employer would have withheld the maximum amount possible would... Didnt owe federal tax last year and expect to owe none this,... Block can help you find out on how many allowances should I claim if Im how many withholding allowances should i claim the U.S. other.