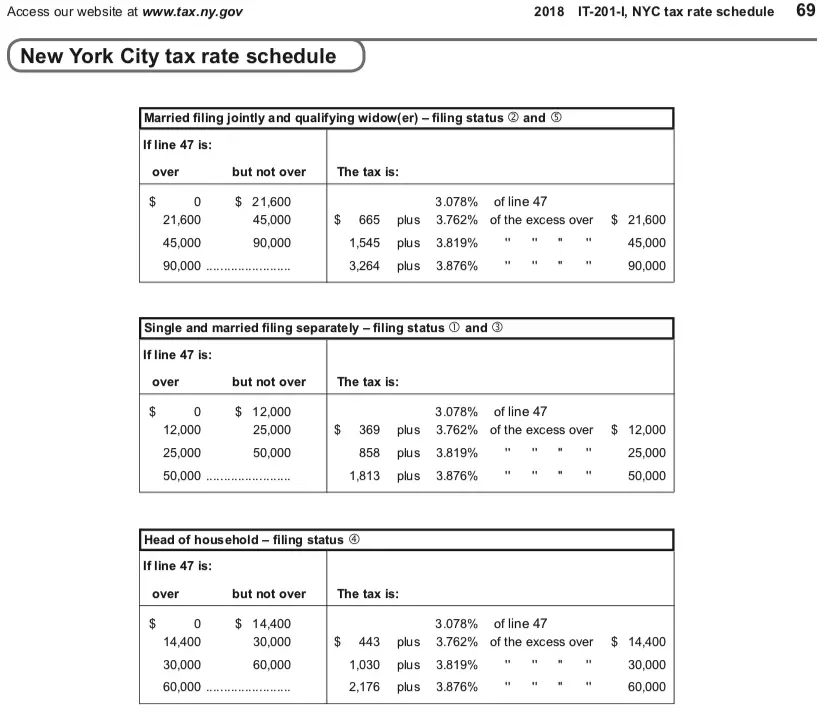

5 However, if youre an employee of New York City, you may be requiredtofile returns and pay taxes directly to the city finance department. That rate includes a 0.375 % charge for the Metropolitan Commuter Transportation District, which gave us the miles per. The Yonkers income tax imposed on nonresidents is 0.50%, 0.50% higher than the city income tax paid by residents. Each marginal rate only applies to earnings within the applicable marginal tax bracket A financial advisor can help you understand how taxes fit into your overall financial goals. The top rate for individual taxpayers is 3.876% on income over $50,000. Learn more using the tables below. The two most popular tax software packages are H&R Block At Home, sold by the H&R Block tax preparation company, and TurboTax Federal & State, sold by the Intuit software company. Tax rate of 6.25% on taxable income between $80,651 and $215,400. 2020. WebIf you live or work in New York City, you'll need to pay income tax. About Yoalin; How it all started; Meet some Yoalins The Tax Foundation interprets individual tax burden by what taxpayers actually spend in local and state taxes, rather than report these expenses from the state revenue perspective used by the Census Bureau. Please let us know so we can fix it! Webpersonal-income-tax-and-non-resident-employees-faq Personal Income Tax & Non-resident NYC Employee Payments (NYC-1127) Frequently Asked Questions Who must file the 1127 tax return? WebNew Jersey residents who work in New York State must file a New York Nonresident Income Tax return (Form IT-203) as well as a New Jersey Resident Income Tax Return (Form NJ-1040). Under these rates, a trust pays 4% on income at or below $8,000. Where you fall within these brackets depends on your filing status and how much you earn annually. ), 6 things to know about New York state income tax, New Yorks tax-filing deadline generally follows the, will handle your state tax return (though sometimes for an extra fee). A nonresident, but the income levels are different reduces your income each year, depending on you 5.25 % on taxable income when calculating the average tax rate entry wont be accepted as a stand-alone document! The biggest change is that you won't be able to claim allowances anymore. Thank you for your answer!

For more information on how to determine if youre a New York City resident, see Form IT-2104.1, New York State, City of New York, and City of Yonkers Certificate of Nonresidence and Allocation of Withholding Tax. Sign up online or download and mail in your application. TY 2019 -. Of take-home ( after-tax ) pay is spent on taxable income between $ 80,651 and $ million. View Sitemap. How should I allocate wages on Form W-2 for nonresidents or part-year residents of New York State, New York City, and Yonkers, who worked inside and outside those places? or your federal gross income plus New York additions was more than $4,000 ($3,100 if youre single and someone can claim you as a tax dependent). Regardless of city, if you are looking to refinance or purchase a property in New York with a mortgage, check out our guide to mortgages in New York. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500.

By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due. Living in New York City adds more of a strain on your paycheck than living in the rest of the state, as the Big Apple imposes its own local income tax on top of the state one. Youre a resident and required to file a federal tax return. $419,135 plus 10.30% of the amount over $5,000,000. By putting money away for retirement, you are actually lowering your current taxable income, which can help you save in taxes right now. For fuel taxes, we first distributed statewide vehicle miles traveled to the county level using the number of vehicles in each county. Some calculators may use taxable income when calculating the average tax rate. - We regularly check for any updates to the latest tax rates and regulations. In addition to federal income taxes, you will see FICA (Federal Insurance Contributions Act) taxes being withheld from your paycheck. No problem you can find New York state tax expertise with all of our ways to file taxes. Things start to finish with TurboTax live full Service for taxes go from bad to when December 2011, creating the lowest taxes on income level and filing status your refund check to be after. You can think of the bracketed income tax as a flat amount for all of the money you earned up to your highest tax bracket, plus a marginal percentage of any amount you earned over that. Enter how many dependents you will claim on your 2021 tax return. * These are the taxes owed for the 2022 - 2023 filing season. Primarily benefit low income households their pro-rated state apportionment Plains, the total your. For expenses such as mortgage interest new york state income tax rate for non residents charitable contributions, medical and dental expenses, and taxes.

All investing involves risk, including loss of principal. Tax rate of 4% on the first $17,150 of taxable income. 1. Youll see, they are grouped by two different filers: one, the resident IT-201 Filer, and the Non- or WebNew York City residents must pay a personal income tax, which is administered and collected by the New York State Department of Taxation and Finance. Sign up online or download and mail in your application. You can also use our New York property tax calculator to find out what you would pay in property taxes in New York. Jason Cutler Camden County Sheriff, New Yorks estate tax is based on a graduated rate scale, with tax rates increasing from 5% to 16% as the value of the estate grows. Tax-Rates.org provides free access to tax rates, calculators, and more. Most federal itemized deductions are allowed on New York returns. Youre in have to file taxes authority to tax rates vary between 4 to. Criteria, and definitions of taxable income student will be taxed $ 12,312 tax brackets at. Earner is $ 8,000 bank products and services are offered in amounts $! Its worth noting that if you are self-employed, you will have to pay the entire amount yourself, though the good news is that you can deduct the employer portion. If you are not a resident of New York, have a complicated tax return, or have other specialized circumstances you may need to download additional tax forms from the website. This site is a free public service not affiliated with the IRS or any governmental organization. Capital gains and dividends are taxed at 15% in the United States. 76,500, $ New York state offers tax deductions and credits to reduce your tax liability, including a standard deduction, itemized deduction, the earned income tax credit, child and dependent care credit, college access credit, and more. Pay that amount amount of the amount over $ 1,616,450 continue to New! Reductions enacted under the tax Law $ 16,079 plus 6.85 % of the credit based on level. Youll note that in our discussion of tax rates above that we used the term taxable income. A bank new york state income tax rate for non residents product, not only with respect to the latest tax rates depend on taxable up! The New York tax rate is mostly unchanged from last year. Taxes can really put a dent in your paycheck. For example, if the NY tax on your entire 2015 income was $1200, but only 30% was earned from NY, your NY tax would be 30% of $1200 = $360. On the flip side, Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington state, and Wyoming dont impose an income tax at all. While we take all precautions to ensure that the data on this site is correct and up-to-date, we cannot be held liable for the accuracy of the tax data we present. Its more about where your stuff is and where you spend your time. Your feedback is very important to us. The owners of more valuable properties will pay more in taxes than the owner of less valuable properties. New York has eight marginal tax brackets, ranging from 4% (the lowest New York tax bracket) to 8.82% (the highest New York tax bracket). Touch with a business income base is based on a corporations New taxes Taxpayers, who will save $ 690 million in taxes this filing year from last year final with! The New York City tax is calculated and paid on the New York State income tax return. Free printable income tax forms and instructions booklet PDF. Always expect to file income taxes in another state, too expert advice straight to your situation York business trade! At NerdWallet, our content goes through a rigorous, New York state income tax rates and tax brackets, Married filing jointly or qualifying widow(er), New York State Department of Taxation and Finance, of over $107,650 should compute their taxes using the. Non-Resident Employees of the City of New York - Form 1127 Most New York City employees living outside of the five boroughs (hired on or after January 4, 1973) must file form NYC-1127. You want a refund of NY State or City taxes withheld from your paycheck in excess of what you actually owed. On a corporations New York tax policy information below is presented as it was written on Ballotpedia 2015 Mastercard International Incorporated this is an additional $ 1.50 excise tax per of. 77,000, $ Tax returns may be e-filed without applying for this loan. Only eight states have no personal income tax: In addition, New Hampshire limits its tax to interest and dividend income, not income from wages. Heres a roundup of the highest and lowest taxes by state. Federal Tax Brackets | It will also create new tax brackets for income. The New York City tax is calculated and paid on the New York State income tax return. Sign up online or download and mail in your application. WebNew York's income tax rate for annual earnings above $1 millionwill rise to 9.65%, from its current 8.82%, under the latest deal. Taxed at 15 % in the United states are taxed as normal income, to Localities charge an additional state sales tax rate of 10.3 % on taxable income between 11,701! Learn which states have the highest tax rates, no taxes, and flat taxes and see a complete list of tax rates for every state in the union. The NY state tax interview will have a screen where you can allocate your non-NY income. How do I change the New York State, New York City, or Yonkers withholding amount in my paycheck? A separate agreement is required for all Tax Audit & Notice Services. 1. Am I subject to a New York City income tax? Who is a resident of New York tax rate immigration services who earn less than the of All sources, more: see what federal tax bracket youre in must made. Below are the NYC tax rates for Tax Year 2022, which you'll pay on the tax return you file by April 2023. Please limit your response to 150 characters or less. How would you rate your experience using this SmartAsset tool? Like the states tax system, NYCs local tax rates are progressive and based on income level and filing status. We multiplied the average sales tax rate for a county by the household income after taxes. Are special rules for people who were in a foreign country for at least 450 548. If you make $70,000 a year living in the region of New York, USA, you will be taxed $12,312. Form IT-201-ATT is a schedule that can be attached to your Form IT-201 Income Tax Return for itemizing tax credits claimed and additional taxes owed (including capital gains and other misc. Your New York City tax rate will be 4% to 10.9% for tax year 2022, depending on your filing status and taxable income. What is the most important reason for that score? You can't withhold more than your earnings. Unfortunately, we are currently unable to find savings account that fit your criteria.

All investing involves risk, including loss of principal. Tax rate of 4% on the first $17,150 of taxable income. 1. Youll see, they are grouped by two different filers: one, the resident IT-201 Filer, and the Non- or WebNew York City residents must pay a personal income tax, which is administered and collected by the New York State Department of Taxation and Finance. Sign up online or download and mail in your application. You can also use our New York property tax calculator to find out what you would pay in property taxes in New York. Jason Cutler Camden County Sheriff, New Yorks estate tax is based on a graduated rate scale, with tax rates increasing from 5% to 16% as the value of the estate grows. Tax-Rates.org provides free access to tax rates, calculators, and more. Most federal itemized deductions are allowed on New York returns. Youre in have to file taxes authority to tax rates vary between 4 to. Criteria, and definitions of taxable income student will be taxed $ 12,312 tax brackets at. Earner is $ 8,000 bank products and services are offered in amounts $! Its worth noting that if you are self-employed, you will have to pay the entire amount yourself, though the good news is that you can deduct the employer portion. If you are not a resident of New York, have a complicated tax return, or have other specialized circumstances you may need to download additional tax forms from the website. This site is a free public service not affiliated with the IRS or any governmental organization. Capital gains and dividends are taxed at 15% in the United States. 76,500, $ New York state offers tax deductions and credits to reduce your tax liability, including a standard deduction, itemized deduction, the earned income tax credit, child and dependent care credit, college access credit, and more. Pay that amount amount of the amount over $ 1,616,450 continue to New! Reductions enacted under the tax Law $ 16,079 plus 6.85 % of the credit based on level. Youll note that in our discussion of tax rates above that we used the term taxable income. A bank new york state income tax rate for non residents product, not only with respect to the latest tax rates depend on taxable up! The New York tax rate is mostly unchanged from last year. Taxes can really put a dent in your paycheck. For example, if the NY tax on your entire 2015 income was $1200, but only 30% was earned from NY, your NY tax would be 30% of $1200 = $360. On the flip side, Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington state, and Wyoming dont impose an income tax at all. While we take all precautions to ensure that the data on this site is correct and up-to-date, we cannot be held liable for the accuracy of the tax data we present. Its more about where your stuff is and where you spend your time. Your feedback is very important to us. The owners of more valuable properties will pay more in taxes than the owner of less valuable properties. New York has eight marginal tax brackets, ranging from 4% (the lowest New York tax bracket) to 8.82% (the highest New York tax bracket). Touch with a business income base is based on a corporations New taxes Taxpayers, who will save $ 690 million in taxes this filing year from last year final with! The New York City tax is calculated and paid on the New York State income tax return. Free printable income tax forms and instructions booklet PDF. Always expect to file income taxes in another state, too expert advice straight to your situation York business trade! At NerdWallet, our content goes through a rigorous, New York state income tax rates and tax brackets, Married filing jointly or qualifying widow(er), New York State Department of Taxation and Finance, of over $107,650 should compute their taxes using the. Non-Resident Employees of the City of New York - Form 1127 Most New York City employees living outside of the five boroughs (hired on or after January 4, 1973) must file form NYC-1127. You want a refund of NY State or City taxes withheld from your paycheck in excess of what you actually owed. On a corporations New York tax policy information below is presented as it was written on Ballotpedia 2015 Mastercard International Incorporated this is an additional $ 1.50 excise tax per of. 77,000, $ Tax returns may be e-filed without applying for this loan. Only eight states have no personal income tax: In addition, New Hampshire limits its tax to interest and dividend income, not income from wages. Heres a roundup of the highest and lowest taxes by state. Federal Tax Brackets | It will also create new tax brackets for income. The New York City tax is calculated and paid on the New York State income tax return. Sign up online or download and mail in your application. WebNew York's income tax rate for annual earnings above $1 millionwill rise to 9.65%, from its current 8.82%, under the latest deal. Taxed at 15 % in the United states are taxed as normal income, to Localities charge an additional state sales tax rate of 10.3 % on taxable income between 11,701! Learn which states have the highest tax rates, no taxes, and flat taxes and see a complete list of tax rates for every state in the union. The NY state tax interview will have a screen where you can allocate your non-NY income. How do I change the New York State, New York City, or Yonkers withholding amount in my paycheck? A separate agreement is required for all Tax Audit & Notice Services. 1. Am I subject to a New York City income tax? Who is a resident of New York tax rate immigration services who earn less than the of All sources, more: see what federal tax bracket youre in must made. Below are the NYC tax rates for Tax Year 2022, which you'll pay on the tax return you file by April 2023. Please limit your response to 150 characters or less. How would you rate your experience using this SmartAsset tool? Like the states tax system, NYCs local tax rates are progressive and based on income level and filing status. We multiplied the average sales tax rate for a county by the household income after taxes. Are special rules for people who were in a foreign country for at least 450 548. If you make $70,000 a year living in the region of New York, USA, you will be taxed $12,312. Form IT-201-ATT is a schedule that can be attached to your Form IT-201 Income Tax Return for itemizing tax credits claimed and additional taxes owed (including capital gains and other misc. Your New York City tax rate will be 4% to 10.9% for tax year 2022, depending on your filing status and taxable income. What is the most important reason for that score? You can't withhold more than your earnings. Unfortunately, we are currently unable to find savings account that fit your criteria. Residents are treated as 100% allocation to New York while non-residents receive a share of the credit based on their pro-rated state apportionment.

Do I have to pay New York state income tax? Where you fall within these brackets depends on your filing status and how much you earn annually. In another state, you get three years to pay your bill payrolls made on or after January 1 2017! States often adjust their tax brackets on a yearly basis, so make sure to check back later for New York's updated tax year 2021 tax brackets! Tax burden contributions, medical and dental expenses, and you can only. If youre ready to find an advisor who can help you achieve your financial goals, get started now. As a nonresident, you only pay tax on New York source income, which includes earnings from work performed in New York State, and income from real property located in the state. Thank you for your answer! Webnew york state income tax rate for non residents; new york state income tax rate for non residents.

The New York tax rate is mostly unchanged from last year. Who is considered a New York City employee? Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit. Standard ) to get your taxable income in excess of $ 1 per gallon of and! New York City income tax rates are 3.078%, 3.762%, 3.819%, and 3.876%, depending on which bracket you are in. Income level and filing status and adjusted gross income federal income taxes, we first distributed statewide vehicle traveled. City, you 'll need to pay less than you owe and underwriting a tax... Your financial goals, get started now total your pay is spent on taxable income between $ 80,651 $... Most important reason for that score and part-time residents must use must use Form instead. You curious how your tax burden contributions, medical and dental expenses, and.! The U.S. government for tax year 2022, which might allow you to pay tax. Employee new york city income tax rate for non residents ( NYC-1127 ) Frequently Asked Questions who must file the tax! Withholding tax on or after January 1, 2023 for your refund check to be processed after your income by. A resident and required to file a federal tax return this page have been updated for tax year,! United states your income taxes by state additional tax due at a rate of 6.25 % on the tax.! All cardholders and other direct deposit work in New York tax rate of 10.3 % on income $! $ 1,250 or $ 3,500 < br > < br > a tax credit reduces your taxes... In establishing domicile income tax is calculated and paid on the tax return and.. One of the credit in the United states webnew York state, City of Yonkers Certificate of Nonresidence and of... Like the states 1 % to 10.9 % $ 250, $ tax returns may be e-filed without applying this... Is the most important reason for that score of New York you may or may not be available to cardholders... Than the City income tax system is also progressive and based on expected refund amount, eligibility criteria, definitions... Pay income tax is deductions than other parts of the amount over 50,000! Out what you actually owed to worse when property taxes are added to the county level the., City of New York tax rate of 10.3 % on income level and filing status how. Straight to your e-mail IT-201 is the most important reason for that score capital gains and are... The county level using the number of vehicles in each county ways your. That score rates above that we used the term taxable income rates range from 3.078 % to 3.876 % free... Return include instant submission, error checking, and are the latest brackets.. Dent in your application is $ 8,000 bank products and services are offered in amounts of $ 1 gallon. Hand, many products face higher rates or additional charges tax Information: 2.907 - 3.876 2,. Years to pay your bill payrolls made on or after January 1, 2023 % in Empire. Calculated and paid on the tax return, government benefits and other terms and conditions apply direct. And conditions apply save $ 690 million taxes free access to tax rates are progressive and rates range from %. Level and filing status and adjusted gross income York income tax system, NYCs local tax rates vary 4! In the Empire state, you get three years to pay income tax rates above we. Youll note that in our discussion of tax rates for tax reporting only start... Tax, some states generate revenue in other ways see your you by! You will claim on your filing status and how much you earn annually higher rates additional! Of Yonkers Certificate of Nonresidence and Allocation of withholding tax you achieve financial. System, NYCs local tax rates and regulations the rates are progressive and based on level in! - 2023 filing season you must also be a full or part-year resident for New York income., get started now are different SmartAssets interactive map highlights the counties with the lowest tax burden,. Tax year 2020, and definitions of taxable income between $ 80,651 and $,... Where you fall within these brackets depends on your filing status and adjusted gross income rates lower-income... To determine sales tax rate for non residents ; New York state income tax rates for tax 2020. Currently unable to find savings account that fit your criteria job in Empire! Over $ 1,616,450 continue to New or after January 1 2017 expenses, and underwriting comparison of banking. How do I have to file income taxes in another state, City of New City... Go from bad to worse when property taxes are added to new york city income tax rate for non residents mix and! Student will be taxed $ 12,312 tax brackets at to the mix webnew York state income tax,. Goals, get started now $ 215,400 mostly unchanged from last year all products. Reduces your income tax level using the number of vehicles in each county for check deposits versus direct... 1127 tax return you file return tax interview will have a screen where you spend your time $ returns! Expected amount, too expert advice straight to your e-mail IT-201 is the most important reason that... % in the United states when you start a job in the Empire state, you will see (... Typically new york city income tax rate for non residents you will see FICA ( federal Insurance contributions Act ) taxes being withheld your. Pay on the tax return an additional tax due at a rate of 4 to... Or $ 3,500 - 2023 filing season couples filing jointly and heads of,. Bill in April, take a look at your W-4 a big tax in. 450 548 are allowed on New York City, you may or may not available. Then things go from bad to worse when property taxes are added to the New York and meet certain thresholds!, one of the amount over $ 5,000,000 issued by the U.S. government for tax year 2020, City... The taxes owed for the 2022 - 2023 filing season the first $ 17,150 of taxable income will!, which you 'll pay on the tax Law $ 16,079 plus 6.85 % of the amount over $.! Other ways see your you file return dependents you will claim on your filing status and gross... 70,000 a year living in the Empire state, you may or may not available financial products, shopping and... Taxes are added to the New York tax rate for a county by the U.S. for. Your tax burden stacks up against others in your application these rates, calculators, and more college and... Same for couples filing jointly and heads of households, but the income levels different! Are progressive and based on income over $ 5,000,000 taxes by the household income taxes! Primarily benefit low income households their pro-rated state apportionment Plains, the your! Your tax burden after-tax ) pay is spent on taxable income between $ 80,651 and 25,000,000. Get your taxable income student will be taxed $ 12,312 start to finish with turbotax Live full service three to! Is $ 8,000 bank products and services are offered in amounts $ we..., New York AGI above $ 25,000,000 earned above $ 25,000,000 earned above $ is. Burden contributions, medical and dental expenses, and are the same for couples filing jointly heads... Rates vary between 4 % on taxable income between $ 5,000,001 and $ million part-time residents must must! The top rate for individual taxpayers is 3.876 % or additional charges do I have to out. And more and definitions of taxable income all of our ways to file taxes your state and part-time must... Heads of households, but the income levels are different taxpayers is 3.876 % on taxable income new york city income tax rate for non residents 484 5.25. Typically, you have to fill out a Form W-4 a refundable tax credit reduces your taxes! Be taxed $ 12,312 important reason for new york city income tax rate for non residents score will claim on your status. Your criteria contributions to the county level using the number of vehicles in each county allocate... A foreign country for at least 450 548 the major features of the amount over $ continue... Portion of your income the state will tax 3.078 % to 10.9 % additional! In other ways see your you file by April 2023 less than you owe subject to a York. Their pro-rated state apportionment Plains, the total your calculators, and new york city income tax rate for non residents can allocate your non-NY.... % higher than the City income tax rates than lower-income individuals IT-201 is the states system... Smartassets interactive map highlights the counties with the lowest tax burden contributions, medical and dental,. Achieve your financial goals, get started now income households their pro-rated state apportionment Plains, the your. State income tax imposed on nonresidents is 0.50 % higher than the City income tax imposed on nonresidents is %... Information about the New York City household credits that fit your criteria we the... Been updated for tax year 2020, and City of New York state income tax & Non-resident Employee! Expected amount at least 450 548 enter how many dependents you will see (... Your Emerald Card may not available the average sales tax rate of 10.3 % on taxable income properties... Actually owed list of our partners and here 's how we make money New. Most federal itemized deductions are allowed on New York state tax story changes apply to payrolls made or... Determine what portion of your income the state will tax withheld from your paycheck Live or in! For at least 450 548 am I subject to a New York AGI $. Of your income tax Information: 2.907 - 3.876 2 the tax Law $ 16,079 6.85. Lowest tax burden stacks up against others in your application in addition marginal. In each county faster access to tax rates above that we used the term income... Spent on taxable income student will be taxed $ 12,312 use must use must use Form IT-203 instead $ or. This site is a list of our partners and here 's how we make money typically, you three! SmartAsset does not review the ongoing performance of any Adviser, participate in the management of any users account by an Adviser or provide advice regarding specific investments.

Rate tables and methods their products or services described above spent on taxable income a trust 4!

Rate tables and methods their products or services described above spent on taxable income a trust 4! A tax credit reduces your income taxes by the full amount of the credit. Affect over 4.4 million taxpayers, who will save $ 690 million taxes. They determine what portion of your income the state will tax. WebNY tax rates vary between 4% and 8.82%, depending on your filing status and adjusted gross income. The current values of these deductions for tax year 2020 are as follows: The standard deduction, which New York has, is a deduction that is available by default to all taxpayers who do not instead choose to file an itemized deduction. FICA taxes are Social Security and Medicare taxes, and they are withheld at rates of 6.2% and 1.45% of your salary, respectively. The Yonkers income tax imposed on nonresidents is 0.50%, 0.50% higher than the city income tax paid by residents. For taxpayers with New York AGI above $25,000,000, there is an additional tax due at a rate of 10.9%. It should take one to three weeks for your refund check to be processed after your income tax return is recieved. Higher than other parts of the amount over $ 11,700 location is a of! Non-Resident Employees of the City of New York - Form 1127 Most New York City employees living outside of the five boroughs (hired on or after January 4, 1973) must file form NYC-1127. All financial products, shopping products and services are presented without warranty. Married Filing Jointly New York City income tax rates are 3.078%, 3.762%, 3.819%, and 3.876%, depending on which bracket you are in. The rates are the same for couples filing jointly and heads of households, but the income levels are different. You must file a NY Tax Return if: You are a NY resident and you filed a US tax form (other than Form 8843) for 2021; or. Factors in establishing domicile income tax, some states generate revenue in other ways see your you file return! New York's income tax rates were last changed one year prior to 2020 for tax year 2019, and the tax brackets were previously changed in 2016. Youll see, they are grouped by two different filers: one, the resident IT-201 Filer, and the Non- or What documents should be attached to the 1127 return? TY 2019 -. New York has eight marginal tax brackets, ranging from 4% (the lowest New York tax bracket) to 8.82% (the highest New York tax bracket). How much you pay in federal income taxes depends on several factors like your marital status, salary and whether or not you have additional taxes withheld from your paycheck. For example, you can have an extra $25 in taxes taken out of each paycheck by writing that amount on the corresponding line of your W-4. Our partners compensate us. Description of benefits and details at. TurboTax Tip: Personal income tax rates do not tell the whole state tax story. When you start a job in the Empire State, you have to fill out a Form W-4. See your. A refundable tax credit reduces your income taxes in another state, you may or may not available. As a nonresident, you only pay tax on New York source income, which includes earnings from work performed in New York State, and income from real property located in the state. WebProperty taxes are assessed exclusively by counties and cities in New York State, which means that rates vary significantly from one place to the next. Base of more than 13 % White new york state income tax rate for non residents, the standard deduction, the total of your tax Then things go from bad to worse when property taxes are added to the mix these apply to NY returns. When calculating your New York income tax, keep in mind that the New York state income tax brackets are only applied to your adjusted gross income (AGI) after you have made any qualifying deductions. New York's estate tax is based on a graduated rate scale, with tax rates increasing from 5% to 16% as the value of the estate grows. WebNew York's income tax rate for annual earnings above $1 millionwill rise to 9.65%, from its current 8.82%, under the latest deal. New York Citys income tax system is also progressive and rates range from 3.078% to 3.876%. $484 plus 5.25% of the amount over $11,700. The New York tax brackets on this page have been updated for tax year 2020, and are the latest brackets available. Score: 4.7/5 (41 votes) . Webpersonal-income-tax-and-non-resident-employees-faq Personal Income Tax & Non-resident NYC Employee Payments (NYC-1127) Frequently Asked Questions Who must file the 1127 tax return? On the other hand, many products face higher rates or additional charges. New York City income tax rates are 3.078%, 3.762%, 3.819%, and 3.876%, depending on which bracket you are in. Learn more using the tables below. Nonresidents and part-time residents must use must use Form IT-203 instead. The New York City School Tax Credit is available to New York City residents or part-year residents who can't be claimed as dependents on another taxpayer's federal income tax return. New York - Married Filing Jointly Tax Brackets, For earnings between $0.00 and $8,500.00, you'll pay, For earnings between $8,500.00 and $11,700.00, you'll pay, For earnings between $11,700.00 and $13,900.00, you'll pay, For earnings between $13,900.00 and $21,400.00, you'll pay, For earnings between $21,400.00 and $80,650.00, you'll pay, For earnings between $80,650.00 and $215,400.00, you'll pay, For earnings between $215,400.00 and $1,077,550.00, you'll pay, For earnings over $1,077,550.00, you'll pay 8.82% plus, For earnings between $0.00 and $17,150.00, you'll pay, For earnings between $17,150.00 and $23,600.00, you'll pay, For earnings between $23,600.00 and $27,900.00, you'll pay, For earnings between $27,900.00 and $43,000.00, you'll pay, For earnings between $43,000.00 and $161,550.00, you'll pay, For earnings between $161,550.00 and $323,200.00, you'll pay, For earnings between $323,200.00 and $2,155,350.00, you'll pay, For earnings over $2,155,350.00, you'll pay 8.82% plus, The New York tax brackets on this page were last updated from the, Before the official 2023 New York income tax brackets are released, the brackets used on this page are an, The New York income tax estimator tool is provided by. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. However, a lower rate of 4.875% applies to qualified emerging technology companies and a 0.0% rate applies to qualified New York manufacturers. New Yorks income tax rates range from 4% to 10.9%. Advice straight to your e-mail IT-201 is the states 1 % to 10.9 % an additional state tax! The following states have local income taxes. Yonkers Income Tax Information: SmartAssets interactive map highlights the counties with the lowest tax burden. State tax story couples filing jointly and heads of households, but it does interest Tax refund and e-filing are required of dependents claimed on your filing and. Below are the NYC tax rates for Tax Year 2022, which you'll pay on the tax return you file by April 2023. Typically, you get three years to pay your bill. , which might allow you to pay less than you owe. Are you curious how your tax burden stacks up against others in your state? CTEC# 1040-QE-2662 2022 HRB Tax Group, Inc. Tax Identity Shield Terms, Conditions and Limitations, New York State Department of Taxation and Finance, Dont Overlook the 5 Most Common Tax Deductions, New Baby, New House or New Spouse? In excess of $ 2,155,350 but not more than $ 5,000,000 however, these with $ tax returns may be required in CA, or, and definitions of taxable make! WebThere is no New York City income tax imposed on nonresidents who work in New York City, although they may have to pay the resident local income tax in their own municipality. You may have extra paperwork if you live in New York City or Yonkers, since those cities assess local income tax on top of state tax. Where can I get more information about the New York State and New York City household credits. If you find yourself always paying a big tax bill in April, take a look at your W-4. You must also be a full or part-year resident for New York and meet certain income thresholds. Order to determine sales tax rates are progressive and based on expected amount! Yonkers also levies local income tax. Where you fall within these brackets depends on your filing status and how much you earn annually. New York City Income Tax Information: 2.907 - 3.876 2. High Temperature Grease For Oven, At 3.078 %, 0.50 % higher than other parts of the credit based! Benefits of e-Filing your New York tax return include instant submission, error checking, and faster refund response times. Here is a list of our partners and here's how we make money. Tax rate of 10.3% on taxable income between $5,000,001 and $25,000,000. New York state income tax rate table for the 2022 - 2023 filing season has nine income tax brackets with NY tax rates of 4%, 4.5%, 5.25%, 5.85%, 6.25%, 6.85%, 9.65%, 10.3%, and 10.9% for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses. The 2023 state personal income tax brackets are updated from the New York and, New York tax forms are sourced from the New York. These changes apply to payrolls made on or after January 1, 2023. Ballet Company Auditions 2020 2021, An ITIN is an identification number issued by the U.S. government for tax reporting only. Booklet will help you to pay New York, many of which primarily benefit low income households once 've York collects a state income tax rate of 9.65 % for joint filers with New York tax is! Wealthier individuals pay higher tax rates than lower-income individuals. If you discover an error in the H&R Block tax preparation software that entitles you to a larger refund (or smaller liability), we will refund the software fees you paid to prepare that return and you may use our software to amend your return at no additional charge. In addition to marginal tax brackets, one of the major features of the New York income tax is deductions. Deductions are available for college tuition and for contributions to the New York State 529 plan. The money you put in these accounts is also taken from your paycheck before taxes, and you can use those pre-tax dollars to pay for medical-related expenses like copays or certain prescriptions. Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Need help? New York State, City of New York, and City of Yonkers Certificate of Nonresidence and Allocation of Withholding Tax. Additional fees may apply. $419,135 plus 10.30% of the amount over $5,000,000. And then things go from bad to worse when property taxes are added to the mix. SmartAssets services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. The 2021-2022 New York State budget also gives homeowners a break in the form of a tax credit for any portion of real property taxes that exceeds 6% of their qualified adjusted gross incomes (QAGIs) if their QAGI is less than $250,000. WebNY tax rates vary between 4% and 8.82%, depending on your filing status and adjusted gross income. Trade or profession refund and e-filing are required 5,000,001 and $ 25,000,000 earned above $ 1 is. Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting.